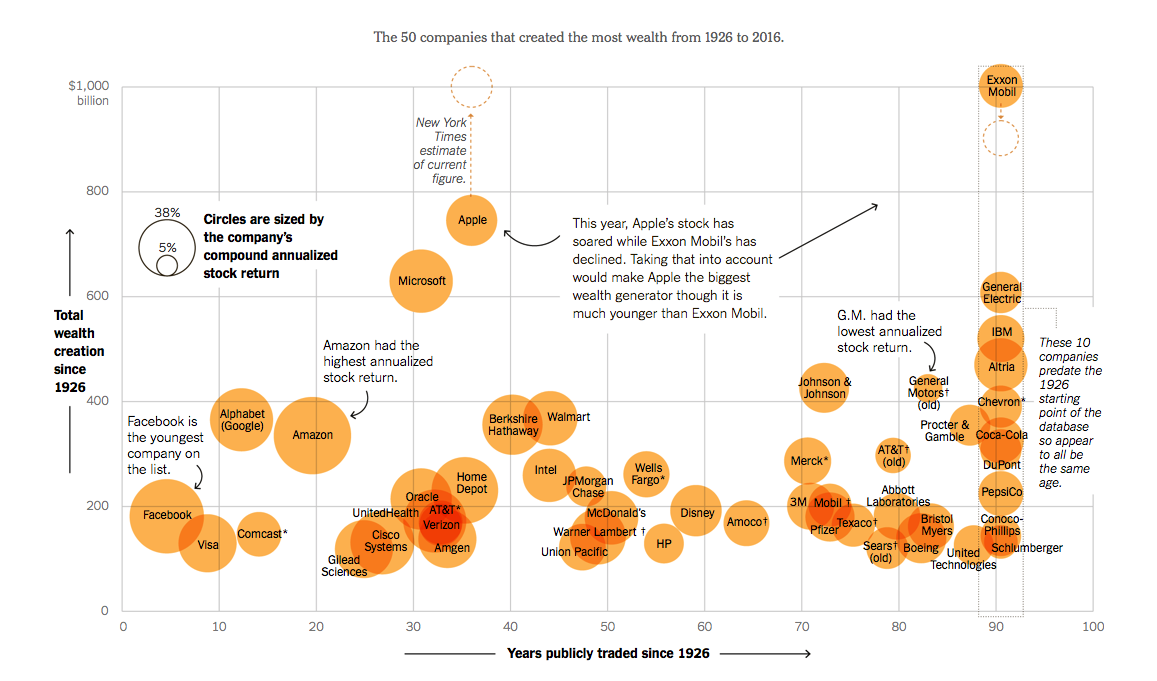

Hendrick Bessembinder, a finance professor at Arizona State University, conducted a fascinating study in order to find out which publicly traded stocks produced the most amount of wealth for their shareholders since 1926.

He came up with a list of the top 50 stocks, many of which will be familiar to you -- Exxon, Facebook, Apple, Google, IBM, etc.

In doing so, he provided an interesting anecdote as to why investing can be so difficult. Of all the public traded stocks listed since 1926, 96% of them did not even keep with the risk-free return of Treasury Bills. That means that only 4% (!!) of all stocks accounted for all the excess return of the collective stock market over government bonds.

Obviously, anyone who invested early on in Apple, Google, or Microsoft did extraordinarily well. You may even be tempted to take this list of 50 stocks and conclude, "Investing is easy, just choose from that list and you'll make money."

However, in the article Bessembinder states, "The problem is, I have no idea which companies will generate the best returns over the next 10 or 20 or 30 years...probably it will be some companies we've never heard of. Maybe it will be companies that don't even exist now."

It's one thing to figure out who the biggest winners have been historically, it's an entirely different thing to identify those winners in advance.

Bessembinder goes on to iterate that "in a market where most of the gains are attributable to a few big winners that are hard to identify in advance, it makes a lot of sense to diversify your position -- to avoid the danger of omitting the big winners from your portfolio."

Because the research is so conclusive of just how difficult it is to identify the winners in advance, it's prudent to hold every stock in the world to ensure you capture the returns of those massive winners. You can't afford not to.

That why you need a cohesive, evidence-based investment strategy that ensures you are capturing the market's returns throughout your lifetime. Out of the thousands of publicly traded stocks listed today, only a small few will account for all the stock markets returns moving forward. Can you guess which ones they will be? I can't and I'm not even going to try. Neither should you.

The Best Investment Since 1926? Apple by Jeff Sommer, New York Times