There likely has never been two mutual fund companies so often compared to one another than Dimension Fund Advisors and Vanguard. Vanguard is the largest mutual fund company in the world, while Dimensional is the 9th largest. Both companies offer investment vehicles that aim to capture market returns, diversifying globally, and at reasonable costs.

One of the major differences between Dimensional and Vanguard is a matter of access. Only clients of Dimensional approved investment advisors (like myself) are able to invest in Dimensional Funds, whereas anyone can use Vanguard.

Dimensionals funds come at a slightly higher cost than Vanguard -- so it's important to understand whether the additional cost would produce enough value to justify it.

Eric Nelson from Servo Wealth introduced me to the following case study of an investor who retired in 2000 and the difference between the Dimensional Equity Balanced Strategy and standard Vanguard Index portfolio for that retiree.

Portfolio 1 - Dimensional Equity Balanced (100% Stock)

Portfolio 2 - Dimensional Equity Balanced (60% Stock, 40% Bond)

Portfolio 3 - Vanguard Total US and International (100% Stock)

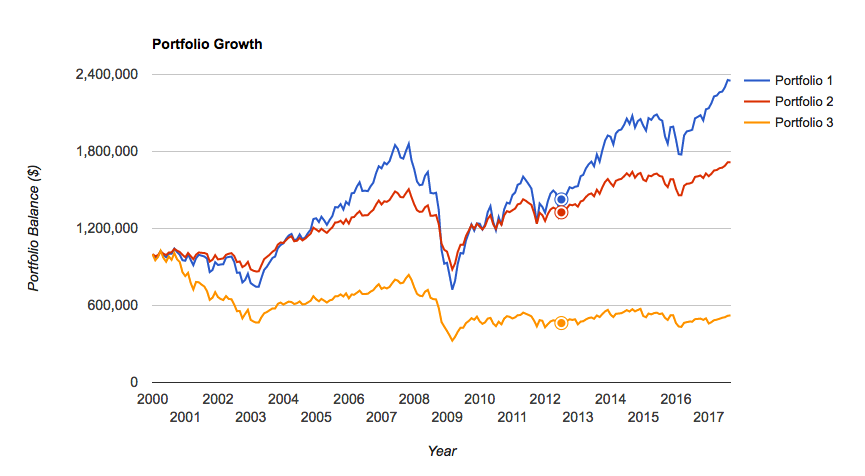

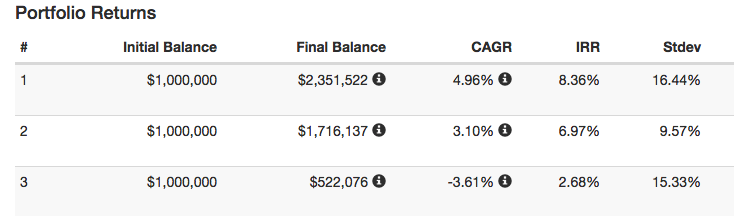

Let's say this hypothetical person retired with $1,000,000 in the year 2000. They withdrew $50,000/year for a 5% withdrawal rate and the portfolio was rebalanced on an annual basis.

Let's look at the results:

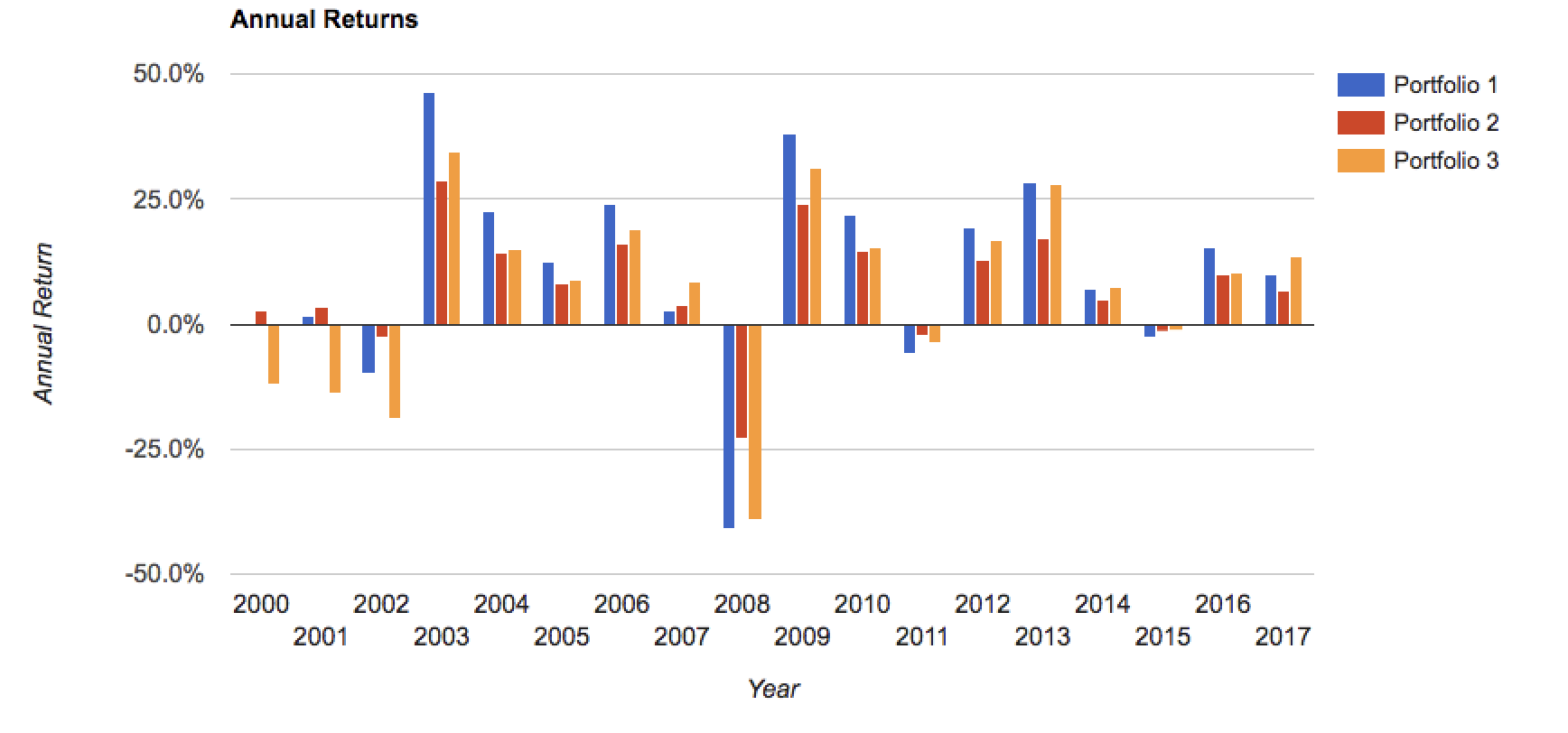

I must say, I was shocked to see the huge difference in performance between Dimension and Vanguard for this time period. It's also amazing to me that through two significant market crashes (tech bubble in 2001, and credit crisis in 2008-9) the disciplined investor, in the right strategy, was able to still experience tremendous compounded returns.

This investor, had he been 100% stocks, would either had ended up with $522,076 invested in the Vanguard Indexes, or whopping $2,351,522 in the Dimensional Strategy. That's quite a significant disparity!

Even while taking a significant amount of risk off the table, and invested in the 60% Stock, 40% Bond Dimensional strategy, he still would have ended up with $1,716,137 -- more than 3 times the 100% Stock Vanguard portfolio.

The reasons for Dimensional's outperformance in these scenarios are their overweighting towards Small Companies, and Value Companies. Both Small and Value companies are in the market's "Dimensions" of higher expected return. There are additional risks associated with Small and Value companies, and since risk and return are related in investing, there is also additional reward for those willing to wait around for the premiums to show up.

For this hypothetical retired investor, in hindsight, the Dimensional approach proved to be the best one. The Small and Value premiums don't show up in every time period, but as in this scenario, I believe the disciplined investor will end up ahead in the Dimensional strategy over the long-term.

See the full portfolio comparison here.