End of Year Market Decline

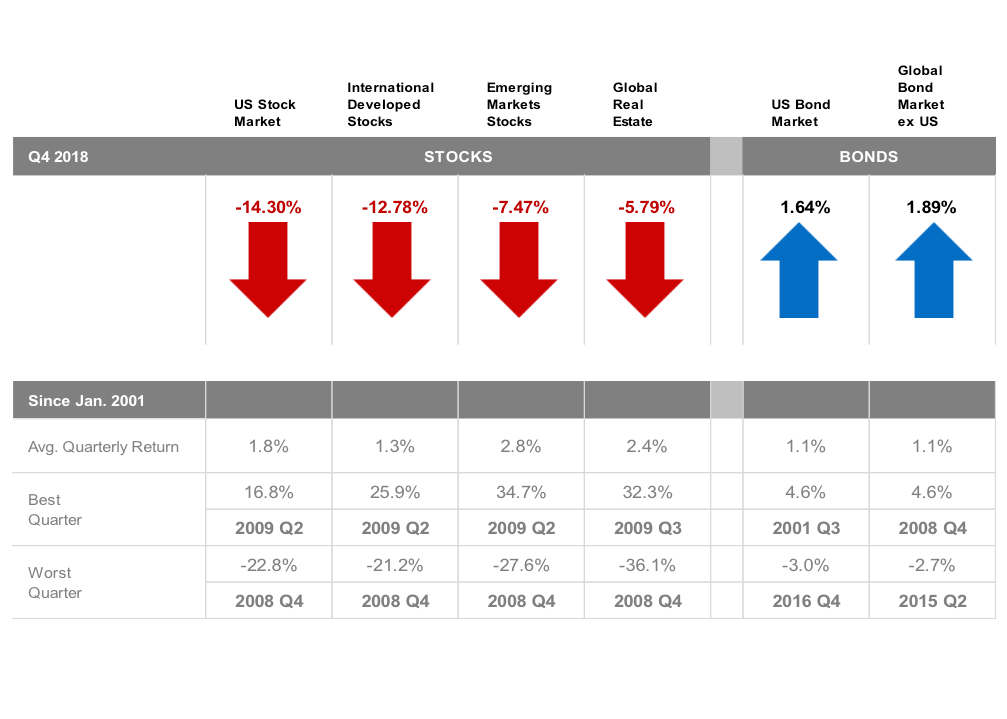

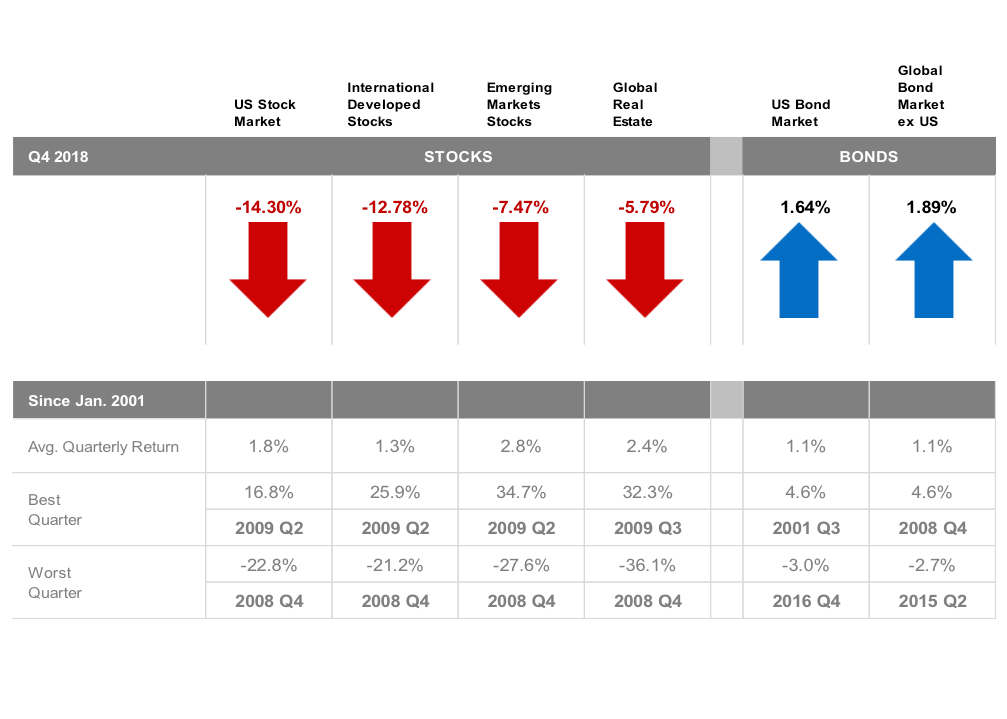

After logging strong returns in 2017, global markets delivered negative returns in 2018 for the only the third time in 10 years. Most markets had been positive in 2018 until the 4th quarter brought a substantial decline in both US and International markets.

After such a decline, many investors wonder how stocks will perform in the near term. However, our job as investors isn't to avoid market declines, but to be positioned to capture all of the gains. The good news is that historically after declines of 10% or more, stock returns over the subsequent 12 months have been positive 71% of the time in the US, and 72% of the time internationally.

The Importance of Diversification and Discipline

The increased market volatility in the fourth quarter of 2018 illustrates the importance of following an investment approach based on diversification and discipline rather than prediction and timing. For investors to successfully predict markets, they must forecast future events more accurately than all other market participants. Not only that, but they must also predict how other market participants will react to their forecasted events. A tall task.

There is little evidence suggesting that either of these objectives can be accomplished on a consistent basis. Instead of attempting to outguess the market, investors should take comfort that time in the market, not timing the market is what leads to long-term investment success.

Small Stocks and Value Stocks Underperformed

As you know, historically small stocks have outperformed large stocks and value stocks have outperformed growth stocks which is why we think it's worth overweighting portfolios to those two dimensions of the market.

However, in 2018 both small and value underperformed their counterparts. We know that small and value won't outperform every single year, in fact, because it doesn't happen every year is the reason it occurs over longer periods. If everyone could bank on it, then it would cease to exist.

Disciplined Investing vs. Speculation

2018 included numerous examples of the difficulty of predicting the performance of markets, the importance of diversification, and the need to maintain discipline if investors want to effectively pursue the long-term returns the capital markets offer. The following quote by John “Mac” McQuown, provides a useful perspective as investors head into 2019:

“Modern finance is based primarily on scientific reasoning guided by theory, not subjectivity and speculation.”

Market volatility has a way of tempting us to engage in speculation, but throughout history, it's the disciplined investor, not the speculator who reaps the market's rewards in the end. If you manage your own portfolio and you aren't sure what the difference is between the two, it might be time to schedule a call to see if some professional guidance might help.

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.