.png)

Do It Yourself (DIY) or Outsource Investments?

Many of the investors I meet with aren't sure whether to try to self-manage their investments or hire a professional. As an investment advisor, my goal is to empower people who want to manage their own financial futures while being honest about what it takes to do so.

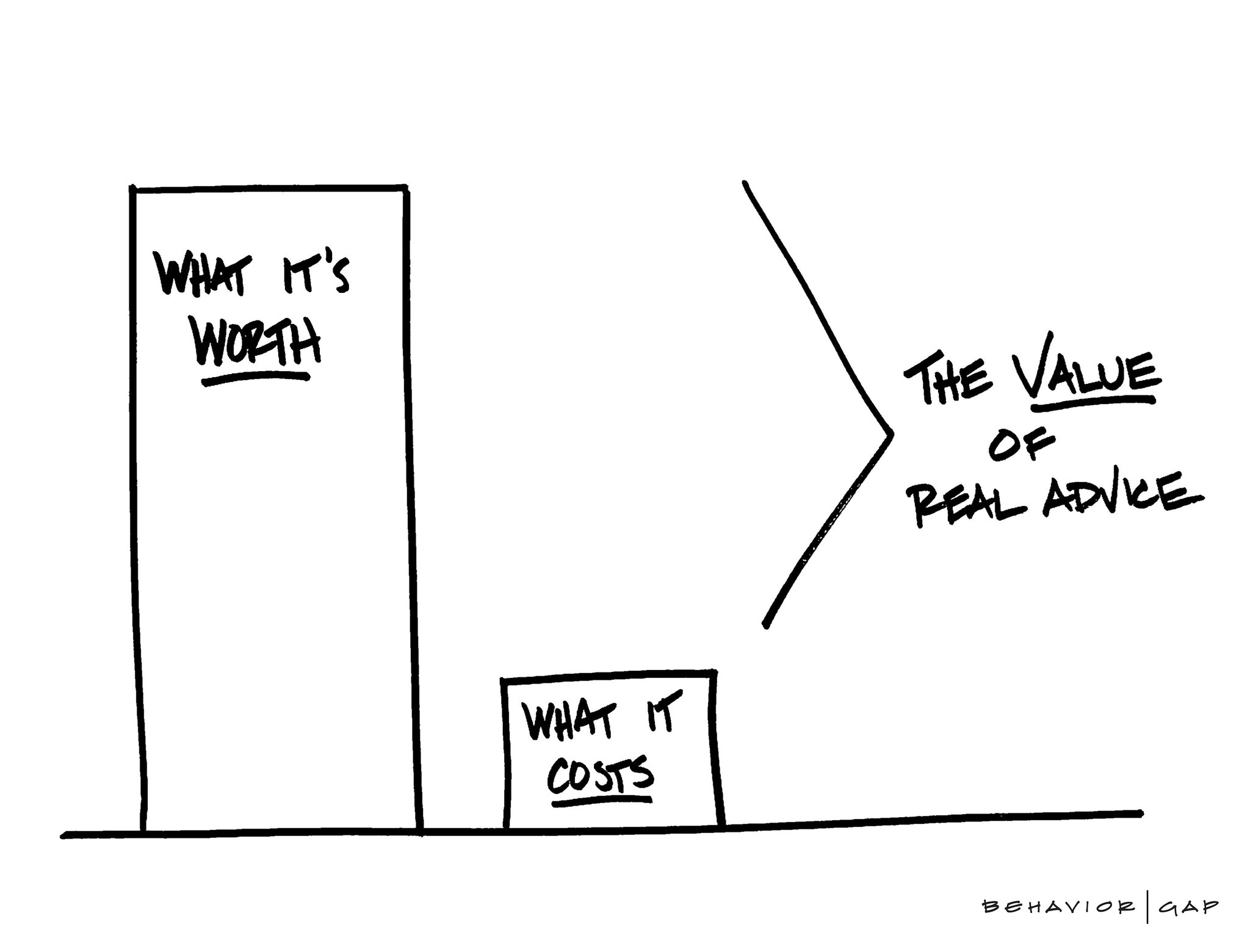

Managing your own portfolio (and managing it well) requires a few important components in order to achieve a better outcome than paying someone else to do it for you. Without these, you might save money by not hiring a professional, but there's a good chance those savings will likely be offset by market losses. By the same token, hiring a professional who understands your situation comes at a price, but the value they provide will likely more than make up for the cost over your lifetime. If you're thinking of managing your own portfolio, ask yourself this: Do you have what it takes to do so successfully?

Investing and Gym Memberships

Investing today is a lot like joining a gym: You can get started for a low monthly fee, you can do research to find the perfect workout program for you, and with enough dedication, you can accomplish your fitness goals all on your own. Some people are perfectly capable of doing those things, but for others, it's not so easy: maybe they don't know what to research, so they don't find the right plan. Or maybe they have trouble staying motivated, so they don't go to the gym as often as they should. For the people in the latter group, it's worth hiring a personal trainer to help them along their journey. The same principle applies to investing.

There is another option now as well: robo advisors. Robo advisors are a digital platform that manages your portfolio for a lower management fee than a human advisor. Continuing the gym analogy, a robo advisor is like a fitness class: it's still on you to get yourself to the class in the same way that it's still a DIY investor's responsibility to save and invest their cash, but once you're there you'll have some guidance (albeit impersonal).

With a robo advisor, you won't have a program that's personalized to your financial needs, and there won't be anyone holding you accountable to your saving and investment goals, so in that sense it's a lot like DIY investing. But, just like DIY investing, robo advisors can still be a great option for a self-motivated person.

The Ingredients You Need to Self-Manage Your Investments

So how do you figure out whether you have what it takes to invest on your own? There are three ingredients required to self manage your portfolio: Time, Interest, and Discipline. If you don’t have all three, then you have a slim chance of doing better than a professional.

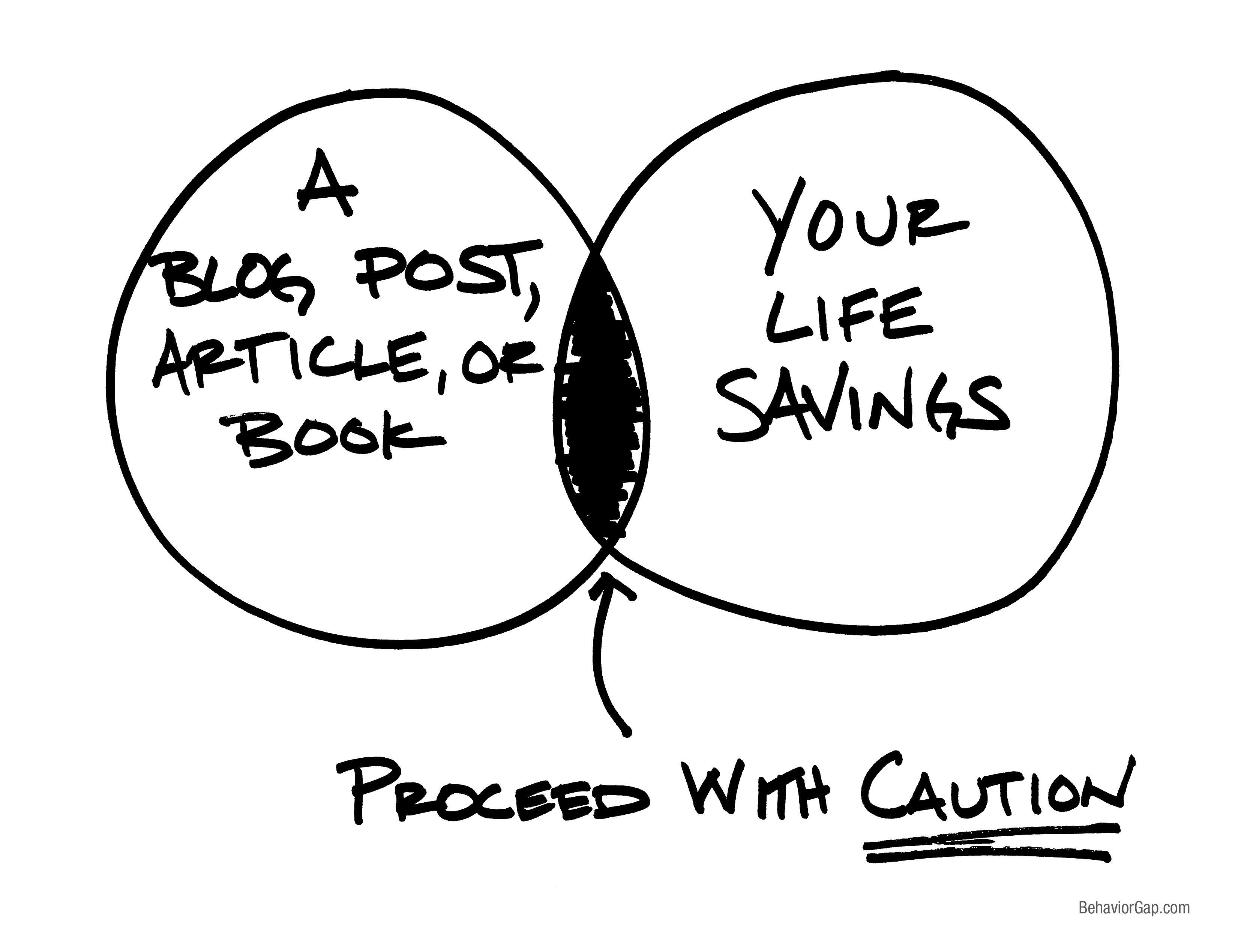

Time — You have to dedicate the time to develop a strategy and maintain it. If you aren’t willing to dedicate the time to read a few books to understand investing (like Random Walk Down Wall Street, The Investor’s Manifesto, The Four Pillars of Investing, The Investment Answer) then you don't have the time to self-manage your portfolio. This is your life savings we're talking about: the stakes are high, and if you can’t make room in your schedule to understand investing or how to develop a investment strategy that is personalized to your situation and goals, then you'd probably be better-suited hiring a professional to manage your portfolio for you.

You also need to consider the opportunity cost of your own time. Could you be spending the time in another way that’s more fulfilling and enriching to your life? Could you be spending it with family? Could you be spending time on things that will further your career or help increase your income? Many clients are perfectly capable of self-managing their portfolios, but they've decided to leave their investments in the hands of a professional and spend their time on other things that are more important to them.

Interest — You won’t dedicate the time to reading and understanding investing unless you have an interest in the subject. Investing is about drawing on vast amounts of information to make smart decisions in the moment, and those smart decisions only come from an existing curiosity and interest in the subject matter that drives you to the right answers.

Many DIYers are willing to sacrifice their time to save money, but if you're not particularly interested in investing, you're only going to be able to retain so much knowledge. We've all taken at least one class in school that we absolutely dreaded. We didn't care about the information, which made it that much more difficult to retain it. If you're only interested in investing because you want to save money on an investment adviser, there's going to be a ceiling on how much you learn. And most likely, you won’t develop the skills and knowledge base required to produce a better outcome for yourself than hiring a professional.

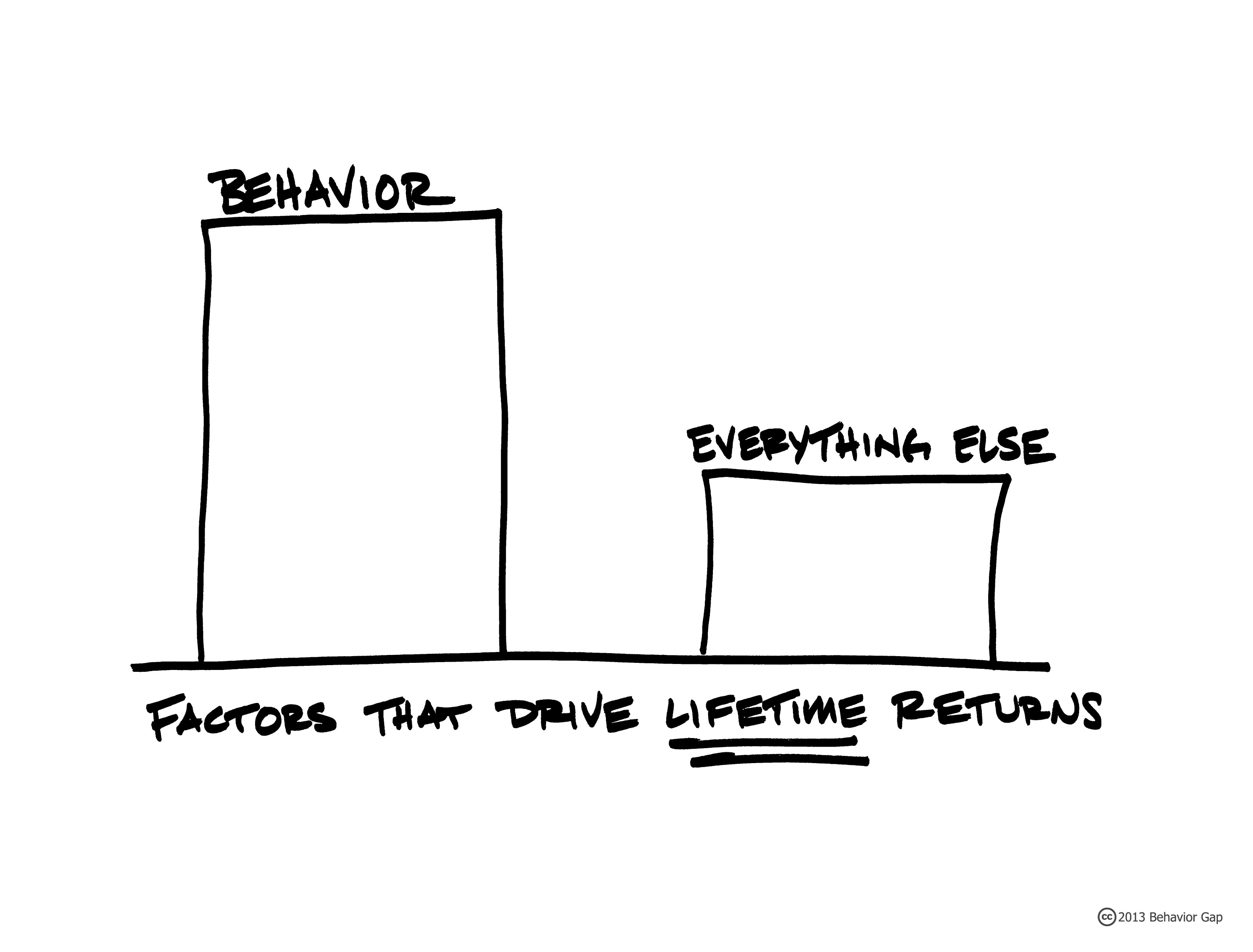

Discipline — This is where the rubber meets the road and requires you to be completely honest with yourself. Investing is a wild ride: your portfolio is going to bounce up and down, and you will constantly be bombarded with scary headlines designed to elicit an emotional response from you. Do you have the discipline fight off your cognitive biases in order to make smart choices? Anyone, no matter how smart or interested they are, can fall into this trap, because it's not a matter of intelligence. It's a matter of being human.

All investment strategies go through periods of "underperformance." If you go the DIY or robo-advisor route, you need to have the utmost confidence in your investment strategy, because it will be up to you avoid the fatal mistake of abandoning it during the rough patches. And finding that kind of confidence is easier said than done.

Investing requires you to act in a way that is contrary to your emotional impulses – usually in the exact opposite way. When the financial world seemed to be ending in 2008-2009 and you felt like throwing up, were you a buyer, a seller, or neither? If you weren't a buyer, you may not have the discipline required to make the cold and calculated decisions in the face of uncertainty needed to achieve the best outcome. Undisciplined DIY investors who didn't rebalance into stocks during that period could have paid a very high investment management fee over the last 10 years and still come out ahead of where they are now.

Investor behavior has an enormous impact on returns – even more than fees/expenses and fund/security selection. When the market is “expensive,” will you be sitting on your cash, or will you continue to invest it prudently? When the markets become volatile, will you still rebalance against the advice of scary headlines? Do you have the time and interest to devise the perfect investment strategy for your goals, and the discipline to stick with that strategy through thick and thin?

Study after study has shown that investors make terrible timing decisions. Dalbar’s famous study demonstrated that due to poor timing decisions, the average investor underperforms their own investments by, on average, 3% per year. Whether it’s because of sitting in cash too long, or cashing out stocks when things get scary, it’s easy to make a reactive investment decision that severely impacts your returns in a negative way.

Investing your own money requires a heavy dose of discipline. If you're not sure if you have that – and most people don't – you might be better off with an advisor who acts as an objective guide for you through turbulent markets to ensure you make the right decisions and avoid damaging investment mistakes.

DIY Investment Risks

As with certain DIY projects around your home, there are certain risks associated with tackling something on your own. You may conclude that the risks are worth taking, but it’s important that you and your spouse understand them and are both on board.

There are many things in life that you can successfully do without professional help. Fixing your kitchen sink, for example, is fairly low-risk. The potential risks of what could go wrong should influence which projects you choose to tackle yourself – if you mess up your sink, it likely won’t be very expensive to fix. (If it is, you should probably avoid DIY projects in the future.)

With investing, however, the cost of making a mistake is enormously high, regardless of your portfolio size. A mistake that costs you $10,000 at age 40 ends up being a $728,000 mistake by age 85 if that $10,000 grew at 10% per year for 45 years. That’s the difference between having a financial legacy to pass on to your children and having to financially depend on your children to take care of you.

Therefore, DIY investing is more like a DIY roof replacement than a sink replacement. Even if you have the Time, Interest, and Discipline to tackle the project, you are still putting yourself on top of a roof and could severely injure yourself. Be aware of the risks you are taking on, and make decisions carefully.

How Many People Have What it Takes?

William Bernstein, a former brain surgeon turned author of several investment books, left the medical field in order to educate investors. He has dedicated his life to empowering people to manage their own investments, but Bernstein eventually realized that while he possessed all of the ingredients to self-manage, most people do not.

Advocating for people to self-manage their investments is like advocating for people do to all of their own car repairs and maintenance — there are a certain percentage of people who can and will, but a majority of people will achieve a better outcome by hiring a skilled mechanic who does it all day and has the necessary tools to do so.

You can do it yourself, but it’s difficult, and I think the 1% estimate is probably about right (of people who have what it takes to self-manage). I came up with actually a theoretical estimate of around one one-hundredth of 1%, but that may be off.

— William Bernstein, M.D.

When it comes to self managing your investments, the key is to be honest with yourself. If you have what it takes, you have the opportunity to save a lot money over time by doing it yourself (assuming you do as well as a professional). In the same way, you could save a lot of money doing your own car repairs, but it's all for nothing if you make a mistake that causes you to lose control of the car while your kids are in the back seat. The stakes are high.

If you have any doubts about whether you possess the ingredients to success, the value you receive from a skilled financial advisor will far outweigh the cost of hiring one. The cost of making financial mistakes is incredibly high; my hope is that this post helps you decide for yourself whether you should to pay a professional to avoid them.

CONTACT US Today FOR INVESTMENT MANAGEMENT HELP

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.