The Executive's Guide to Non-Qualified Deferred Compensation Plans: Opportunities, Risks, and Strategies

Watch our video explanation below for key insights on deferred compensation plans, or continue reading for a comprehensive guide to maximizing benefits while minimizing risks in your NQDC strategy.

If you're an executive at 3M, Boston Scientific, Target, or any other major corporation, there's a good chance you have deferred compensation as an option on your benefits sheet. We call it non-qualified deferred compensation, or NQDC for short. These plans offer tremendous tax advantages, but they're also complex and come with risks that aren't always clearly explained.

These plans first emerged in the 1980s when a congregation set up a special trust to defer a rabbi's compensation. The IRS challenged it but ultimately agreed the money wasn't taxable yet since it remained the synagogue's property. This created the foundation for today's NQDC plans—and their inherent risks, since the deferred money stays on the company's books and could be lost if the company faces financial difficulties.

While the tax benefits can be substantial, there's a critical balance between tax optimization and risk management that every executive needs to understand.

Table of Contents:

- What Are Non-Qualified Deferred Compensation Plans?

- How NQDC Plans Differ from Qualified Plans (401(k)s, etc.)

- Tax Planning Opportunities with NQDC Plans

- The Significant Risks of NQDC Plans

- Is an NQDC Plan Right for You? A Decision Framework

- Common Mistakes to Avoid with NQDC Plans

- Impact of Employment Changes on Your NQDC Plan

- Creating an NQDC Strategy That Works

- Special Considerations for Minnesota Executives

- Conclusion

- FAQs About Non-Qualified Deferred Compensation Plans

What Are Non-Qualified Deferred Compensation Plans?

Non-qualified deferred compensation is exactly what it sounds like – you elect to not receive part of your compensation today, with the promise you'll receive it later. This arrangement allows you to defer taxes until you actually receive the money.

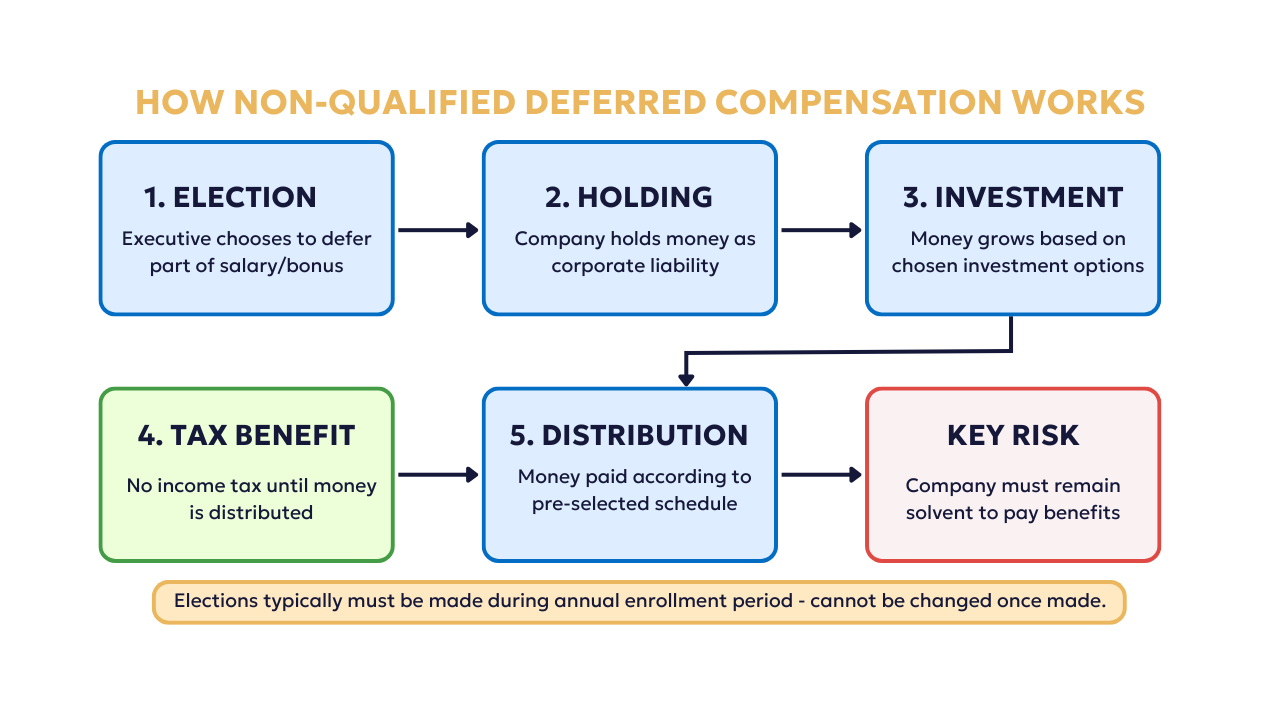

So what happens when you participate in an NQDC plan?

First, typically around November or during open enrollment, you'll receive notification that you can elect to defer part of your salary or bonus. Unlike 401(k) plans with strict contribution limits, NQDC plans allow you to defer much larger amounts – that's a significant advantage for highly compensated executives.

Second, you'll choose when to receive the money. Your options might include:

- A specific future date (e.g., 5 or 10 years from now)

- At retirement

- Upon separation from the company

This is where many executives make mistakes. If you select a date while you're still working and in a high tax bracket, you could undermine the main tax advantage of these plans.

Third, you'll typically select investment options for the deferred amount. While the money technically remains the company's asset, most plans allow you to direct how it's invested, similar to a 401(k).

Finally, you'll choose a distribution method – lump sum or installments over several years. This decision significantly impacts your future tax situation and should align with your broader financial plan.

These plans vary significantly between companies. Some Minnesota employers like Target and 3M have robust plans with diverse investment options, while others offer more limited choices. The distribution options, deferral limits, and investment selections all differ, making it essential to understand your specific plan's details.

How NQDC Plans Differ from Qualified Plans (401(k)s, etc.)

Understanding the key differences between non-qualified deferred compensation plans and qualified plans like 401(k)s is essential for making informed decisions about your financial future.

The most obvious advantage of NQDC plans is the absence of IRS contribution limits. While 401(k) plans cap your annual contributions (in 2025, the limit is $23,000 plus an additional $7,500 if you're over 50), NQDC plans allow you to defer significantly more income. This makes them particularly valuable for executives who want to shelter more of their compensation from current taxation.

However, this advantage comes with significant trade-offs:

Security and Protection

Your 401(k) assets are held in a separate trust, protected from your employer's creditors even if the company faces bankruptcy. This ERISA protection doesn't extend to NQDC plans – your deferred compensation remains an unsecured promise from your employer. If your company faces financial difficulties, your deferred compensation could be at risk.

Tax Treatment

While both plans defer taxation on contributions, the similarities largely end there:

- 401(k) withdrawals can begin penalty-free at age 59½, with required minimum distributions at age 73

- NQDC plans follow your predetermined distribution schedule, regardless of age

- 401(k) plans offer more flexibility for emergency withdrawals (though penalties may apply)

- NQDC plans generally lock in your distribution decisions with limited or no changes permitted

Eligibility

NQDC plans are only offered to select employees, typically executives and highly compensated individuals. This selective availability is by design – if these plans were broadly available to all employees, they would need to meet ERISA requirements that would eliminate much of their flexibility.

Investment and Distribution Flexibility

While 401(k) plans typically offer standard investment options, NQDC plans often provide more flexible distribution options. You can generally schedule distributions for specific future dates – not just at retirement – without penalties. This can be valuable for planning around specific financial needs or anticipated lower-tax years.

The different tax treatment and security profile of these plans means they should be prioritized differently in your financial planning. I generally recommend maxing out your 401(k) before considering an NQDC plan due to the security difference alone.

Tax Planning Opportunities with NQDC Plans

The most compelling reason to consider an NQDC plan is the potential for significant tax savings. Let's look at how this might work in practice.

Deferring a $50,000 Bonus: A Case Study

Imagine you're deciding what to do with a $50,000 bonus. Let's compare two approaches:

This illustrates the power of:

- Deferring taxes on the initial amount

- Tax-deferred growth on the full sum

- Potentially lower tax rates in retirement

- Possible state tax savings through relocation

Strategic Distribution Timing

The timing of your distributions is critical to maximizing tax benefits. Poor planning can negate much of the advantage of deferral.

Many executives make the mistake of setting distribution dates while they're still working and in high tax brackets. For optimal results, coordinate your distributions with your broader retirement income plan to maintain the lowest possible tax bracket each year.

Another common error is "stacking" too many distributions in a single year. This can push you into higher tax brackets and diminish the benefits of deferral. Spreading distributions across multiple years often results in lower overall taxation.

State Tax Considerations for Minnesota Executives

Minnesota's top income tax rate of 9.85% is among the highest in the nation. This creates an additional planning opportunity - if you anticipate relocating to a lower-tax or no-income-tax state in retirement, deferring compensation could save you nearly 10% in state taxes alone.

However, timing matters. Minnesota may attempt to tax deferred compensation earned while you were a resident, even after you've moved. Proper planning around your relocation timing and distribution schedule is essential.

Early Access Advantage

Unlike qualified retirement plans with their 10% penalty for withdrawals before age 59½, NQDC plans allow you to access funds according to your predetermined schedule without early withdrawal penalties. This makes them valuable for bridging the gap if you plan to retire before 59½.

The tax planning opportunities with NQDC plans are substantial, but they require careful integration with your overall financial plan, retirement timeline, and potential relocation plans. When executed properly, the tax savings can significantly enhance your long-term financial position.

The Significant Risks of NQDC Plans

After discussing the compelling tax benefits, I need to emphasize the significant risks that come with NQDC plans. These risks aren't theoretical – they've impacted executives at many once-stable companies.

The "Unsecured Promise"

The fundamental risk of deferred compensation is that it represents an unsecured promise by your employer. Unlike your 401(k), which is held in a separate trust protected from your employer's creditors, your deferred compensation remains on the company's books as a liability.

This means that if your company faces financial difficulties or bankruptcy, your deferred compensation could be at risk. You would likely become an unsecured creditor of the company, standing in line behind secured creditors, with potentially little or no recovery of your deferred funds.

When Good Companies Face Bad Times

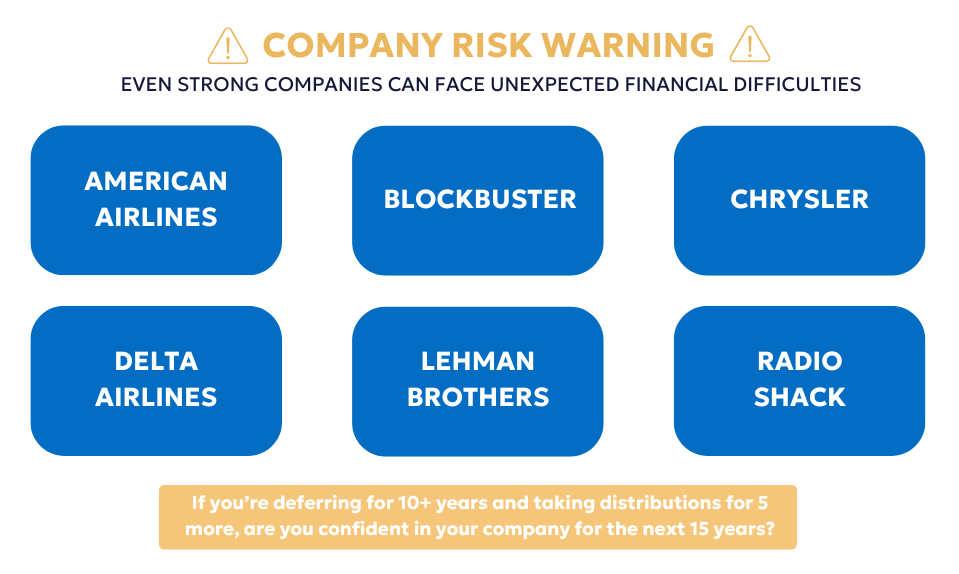

Everyone loves their own company and has confidence in its future, but history is littered with examples of seemingly stable companies that faced unexpected financial problems:

Many of these failures were unexpected and occurred quickly. The executives at these companies likely felt confident about deferring compensation – until they weren't.

The Double Whammy: Market Timing Risk

What makes this risk particularly concerning is that company financial problems often coincide with broader market turmoil. Consider this scenario:

- The market enters a downturn

- Your 401(k) and other investments lose value

- Your company faces financial strain in this environment

- You get laid off or are forced to retire earlier than planned

- Your deferred compensation becomes at risk or is lost entirely

This creates a perfect storm where multiple sources of retirement security are threatened simultaneously – exactly when you might need them most.

The 20% Rule

Given these risks, I strongly recommend that executives limit their exposure to deferred compensation. My rule of thumb is that no more than 20% of your retirement assets should be in deferred compensation plans.

At this level, even if the worst happens and you lose your deferred compensation, it's a mistake you can recover from by adjusting spending or other aspects of your retirement plan. If deferred compensation represents 50% or more of your retirement assets, the impact could be devastating.

Minnesota Company Risk Assessment

Minnesota is home to several stable Fortune 500 companies, but stability is always relative and temporary. Consider these factors when assessing your company's risk profile:

- Company debt levels and credit rating

- Industry disruption potential

- Competitive position

- Geographic concentration

- Revenue diversity

Even strong Minnesota companies like 3M have faced challenges in recent years that might have seemed unlikely a decade ago.

Some companies use a "Rabbi Trust" to hold deferred compensation in a separate account, which can feel more secure. However, these trusts still remain subject to the company's creditors in a bankruptcy scenario, so the fundamental risk remains.

The longer you plan to defer compensation, the more critical this risk assessment becomes. Being confident in your company's outlook for the next 2-3 years is reasonable – but can you realistically predict its stability over 10-15 years, especially after you're no longer working there?

Is an NQDC Plan Right for You? A Decision Framework

Given the tax advantages and substantial risks we've discussed, how do you decide if an NQDC plan makes sense for your situation? Let's establish a clear framework to guide your decision.

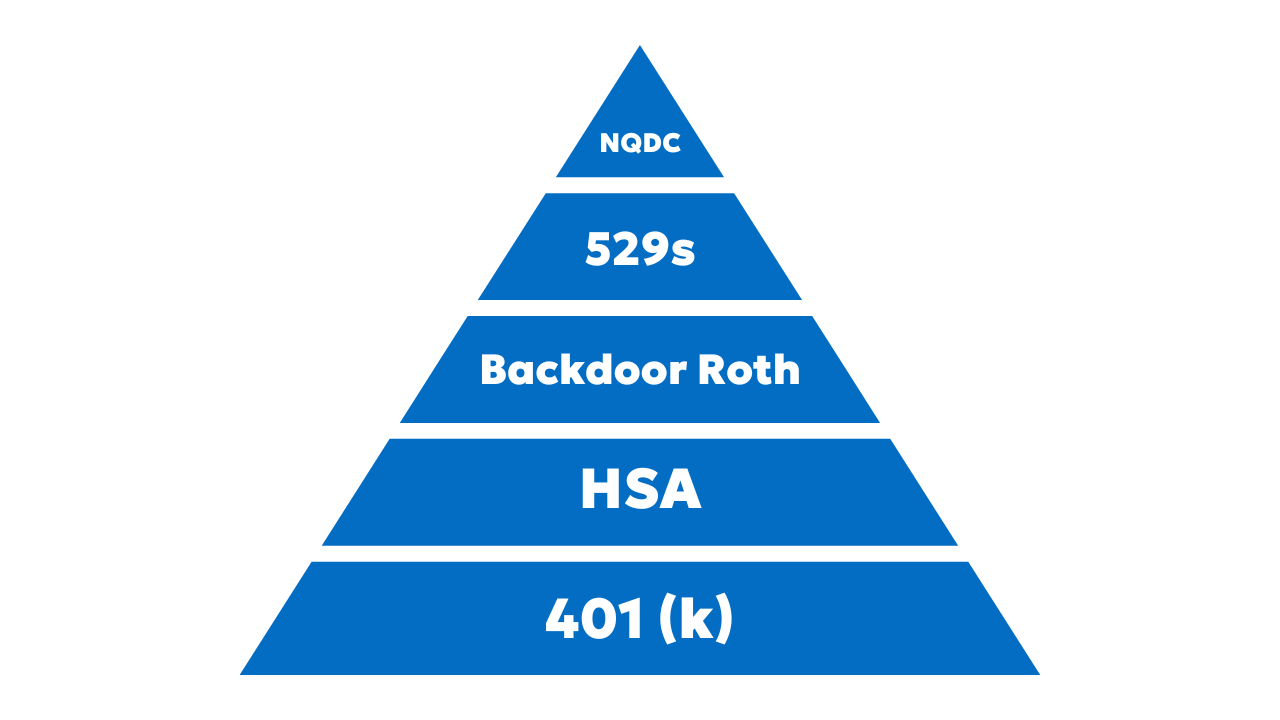

The Retirement Savings Hierarchy:

Before considering deferred compensation, you should follow this priority sequence for retirement savings:

- Max out your 401(k)first - This provides tax advantages with much greater security. For 2025, contribute the maximum $23,000 (plus $7,500 catch-up if you're over 50).

- Utilize an HSA if eligible - Health Savings Accounts offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. They're powerful retirement planning tools that are often overlooked.

- Execute backdoor Roth IRA contributions This strategy allows high-income earners to fund Roth IRAs despite income limitations. The tax-free growth and withdrawals make this an essential planning tool for executives.

- Fund 529 plans for education needs If you have children or grandchildren whose education you plan to support, fund these accounts appropriately before considering deferred compensation.

- Then (and only then) consider NQDC plans Once you've maximized these more secure tax-advantaged vehicles, deferred compensation might be appropriate.

Financial Indicators That Suggest NQDC Plans Might Work For You

Deferred compensation tends to be most valuable when:

- You're consistently maximizing all available tax-advantaged accounts and still have excess cash flow

- You anticipate being in a significantly lower tax bracket in retirement

- You're experiencing "tax pain" from substantial capital gains and investment income

- You have a sizable taxable investment account (typically $250,000+) where tax efficiency is becoming a concern

- You're willing to accept some risk for the potential tax benefits

- You have confidence in your employer's long-term financial stability

- Your retirement plan is robust enough to withstand the potential loss of deferred compensation

Warning Signs That NQDC May Not Be Appropriate

Deferred compensation might not be suitable if:

- You have inadequate emergency reserves (typically 6-12 months of expenses)

- You have high-interest debt that should be prioritized

- You're not already maximizing your 401(k) or other more secure retirement vehicles

- You anticipate near-term cash flow needs for major purchases, education expenses, etc.

- Your company's financial position shows signs of instability

- Your industry faces significant disruption risk

- You're early in your career with potential job changes ahead

- You already have substantial deferred compensation relative to your total retirement assets

Key Questions To Ask About Your Company's Plan

Before participating, make sure you understand:

- What are the exact deferral election deadlines and rules?

- What investment options are available within the plan?

- What distribution options are available (timing and payment structure)?

- Can elections be changed after they're made, and under what circumstances?

- What happens to deferred compensation if you leave the company voluntarily or involuntarily?

- Does the company use a Rabbi Trust or other mechanism to segregate funds?

- What is the financial health of the company, and has it ever frozen or modified its deferred compensation obligations

- Are there any special provisions for change in control or company acquisition?

Common Mistakes to Avoid with NQDC Plans

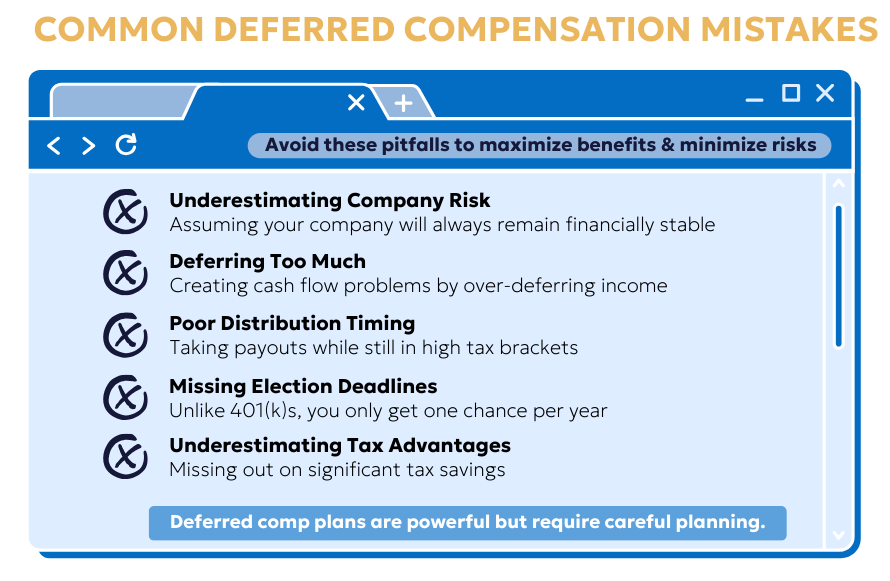

After working with numerous executives on their deferred compensation decisions, I've seen several common mistakes that can significantly undermine the benefits of these plans. Being aware of these pitfalls can help you avoid costly errors.

Underestimating Company Risk

This is perhaps the most dangerous mistake. Many executives have an inherent optimism about their employer's future – after all, your career success is often tied to the company's success. This can lead to underestimating the genuine risk that deferred compensation represents.

Remember that many once-thriving companies have faced unexpected difficulties. Your decision should be based on an objective assessment of your company's financial health, not just your confidence in its future performance. The fact that a company has been successful for decades doesn't guarantee its continued stability, especially over the lengthy timeframe of deferred compensation.

Deferring Too Much Income

I've seen executives become so enamored with the tax benefits that they defer excessive amounts of their compensation, only to find themselves cash-constrained when unexpected expenses arise. This is particularly problematic because deferred compensation typically cannot be accessed early, even for emergencies.

Before making deferral elections, ensure you have:

- Adequate emergency reserves

- Sufficient cash flow for anticipated major expenses

- Flexibility to handle unexpected costs

- Liquidity for opportunities that may arise

The tax benefits of deferral mean little if you're forced to take on high-interest debt to cover expenses that arise before your deferred compensation becomes available.

Poor Distribution Timing

Many executives select distribution dates without considering their broader tax situation. Common mistakes include:

- Scheduling distributions for years when you're still working and in high tax brackets

- Clustering too many distributions in a single year, pushing you into higher brackets

- Not coordinating NQDC distributions with other retirement income sources

- Setting distribution dates that don't align with anticipated expenses

The ideal strategy typically involves spreading distributions across multiple years during retirement to maintain the lowest possible tax brackets while meeting your income needs.

Missing Election Deadlines

Unlike 401(k) plans where you can generally change contribution levels throughout the year, NQDC plans have strict election deadlines – typically during annual enrollment periods. Once these deadlines pass, you cannot participate until the next enrollment period.

Even worse, many plans require you to make distribution elections at the time of deferral. These elections are often irrevocable, meaning a hasty decision during enrollment could lock you into a suboptimal distribution schedule for years to come.

Failing to Coordinate with Broader Planning

Deferred compensation shouldn't be viewed in isolation. I often see executives making deferral decisions without considering how they fit into their overall retirement and tax planning. Your NQDC strategy should be coordinated with:

- Social Security claiming strategy

- Required Minimum Distributions from qualified plans

- Roth conversion planning

- Estate planning objectives

- Charitable giving strategies

- Spouse's retirement income

Not Adapting to Changing Circumstances

Life doesn't always follow our plans. Major life changes can significantly impact the wisdom of past deferral decisions:

- Career changes might lead to separation from your employer earlier than anticipated

- Relocation plans might affect state tax considerations

- Health challenges might necessitate earlier retirement

- Family circumstances might change your cash flow needs

While you can't predict everything, you should reassess your deferred compensation strategy regularly as your life circumstances evolve. Future deferral decisions should account for these changes, even if past elections cannot be modified.

Impact of Employment Changes on Your NQDC Plan

One of the most significant considerations with deferred compensation is how it's affected by changes in your employment status. Unlike your 401(k), which remains yours regardless of employment changes, your deferred compensation can be dramatically impacted by job transitions.

What Happens When You Leave the Company

The treatment of your deferred compensation when you leave your employer depends entirely on your specific plan's terms. There are typically three possible outcomes:

- Accelerated Distribution: Some plans require immediate or accelerated distribution of your deferred compensation upon separation. This could force you to recognize all that income in a single tax year – potentially at the worst possible time from a tax perspective.

- Continued According to Schedule: More favorable plans allow your deferred compensation to be paid out according to your original distribution elections, even after you leave. The money remains subject to the company's creditors until fully distributed.

- Forfeiture: In the most restrictive plans, you might forfeit some or all of your deferred compensation if you leave before specific dates or conditions are met. These "golden handcuff" provisions are designed to encourage retention.

Before participating in an NQDC plan, it's crucial to understand which approach your employer's plan takes and how it aligns with your career plans and time horizon.

Voluntary vs. Involuntary Termination

Many plans distinguish between voluntary and involuntary termination:

- Voluntary Resignation: Often triggers less favorable treatment, potentially including forfeiture of unvested amounts or acceleration of payouts

- Involuntary Termination: May provide more favorable treatment, especially in "without cause" scenarios, though this varies significantly by plan

- Retirement: Typically defined by specific age and/or service requirements, often results in the most favorable treatment, allowing distributions to continue according to schedule

If you're approaching retirement age, the definition of "retirement" in your plan becomes critically important. Some plans might require you to reach a specific age combined with years of service to qualify for favorable treatment. Understanding these provisions might influence your timing decisions about when to retire.

Change of Control Provisions

Mergers, acquisitions, and other significant corporate events can create uncertainty for deferred compensation participants. Most plans include specific "change of control" provisions that determine what happens to your deferred compensation in these scenarios:

- Some plans accelerate vesting and distribution upon a change of control

- Others maintain the original schedule but transfer the obligation to the acquiring company

- Some have hybrid approaches that provide options to participants

These provisions have become increasingly important as merger and acquisition activity continues to reshape corporate America. In Minnesota specifically, several major companies have gone through significant transformations in recent years, highlighting the importance of understanding these provisions.

Protecting Yourself During Transitions

While you can't completely eliminate the risks associated with employment changes, you can take steps to mitigate them:

- Understand Your Plan: Thoroughly review your plan document, particularly sections dealing with separation, retirement definitions, and change of control provisions.

- Diversify Your Deferrals: Instead of making large deferrals in a single year, consider smaller deferrals spread across multiple years with varying distribution dates.

- Time Your Exit Strategically: If possible, coordinate your departure with your distribution schedule or retirement definition in the plan.

- Document Everything: Maintain copies of all plan documents, election forms, and account statements to protect your interests in case of disputes.

- Negotiate During Transitions: If you're being recruited away from your current employer, consider asking your new employer to compensate you for any deferred compensation you might forfeit or that might be distributed at an inopportune time.

The impact of employment changes represents one of the most significant risks of deferred compensation plans. By understanding these implications before making deferral elections, you can make more informed decisions that align with your career trajectory and minimize potential adverse consequences.

Creating an NQDC Strategy That Works

After understanding the benefits and risks of deferred compensation plans, the next step is developing a strategic approach that works for your specific situation. A well-designed NQDC strategy requires careful consideration of multiple factors across your entire financial picture.

Determining the Optimal Deferral Amount

The right amount to defer is a balancing act between maximizing tax benefits and managing risk:

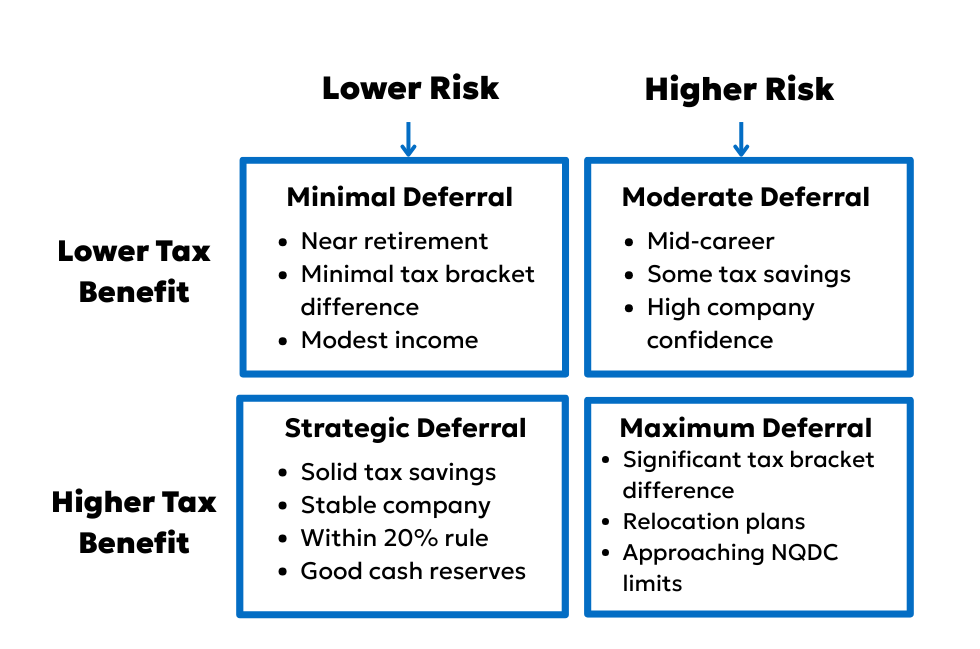

NQDC Decision Matrix:

Beyond this matrix, consider:

- Your actual cash flow needs (only defer "excess" income)

- Major upcoming expenses that will require liquidity

- Your company's financial stability and industry outlook

- The psychological comfort of having assets under your direct control

Selecting the Right Distribution Timing

Distribution timing can make or break your NQDC strategy. Consider these approaches:

The Retirement Bridge Strategy - Perfect for executives planning early retirement, this approach schedules distributions to provide income between retirement and when other retirement income (Social Security, pensions) begins.

The Tax-Bracket Ladder - Schedule distributions to "fill up" lower tax brackets each year, maintaining the most favorable tax treatment possible throughout retirement.

The Milestone Approach - Time distributions to coincide with planned major expenses – college tuition payments, a vacation home purchase, or charitable giving goals.

The Geographic Arbitrage Play - For executives planning to relocate in retirement, this strategy delays distributions until after establishing residency in a lower-tax state.

A hybrid approach often works best, with distributions starting a year or two after retirement and spread across 5-10 years to maintain tax efficiency.

Balancing NQDC With Your Broader Financial Picture

Your deferred compensation strategy shouldn't exist in isolation – it should be one piece of your comprehensive financial puzzle:

| Financial Element |

NQDC Integration Approach |

| Investment Strategy | Balance NQDC risk with more conservative positions in other accounts |

| Tax Planning | Coordinate NQDC with Roth conversions, charitable giving, and capital gains strategies |

| Estate Planning | Ensure beneficiary provisions align with overall estate plan |

| Risk Management | Consider additional life/disability insurance to offset NQDC risk |

| Spouse's Planning | Diversify employer risk across both careers |

| Legacy Goals | Structure distributions to align with philanthropy or wealth transfer objectives |

A Case Study: Executive Tom's NQDC Strategy

Tom, a 52-year-old VP at a Minnesota-based healthcare company, plans to retire at 62. His strategy:

1. Gradual Deferral Approach: Instead of maxing out deferrals, Tom defers 15% of his base salary and 40% of his annual bonus – keeping his total NQDC balance under 18% of his retirement assets.

2. Distribution Planning: Tom structured his deferrals with varying distribution schedules:

- 30% to begin at age 62 (year of retirement)

- 40% to begin at age 64 (coordinated with pension start)

- 30% to begin at age 66 (when Social Security benefits start)

3. Integration: Tom's strategy allowed him to:

- Maintain stable income throughout early retirement

- Keep his tax bracket lower than it would be with lump-sum distributions

- Provide time to execute Roth conversions of his 401(k) during lower-income years

- Coordinate with his wife's retirement plans from a different employer

The key to Tom's success wasn't maximizing deferrals – it was strategic integration with his overall financial plan and thoughtful distribution timing.

Creating an effective deferred compensation strategy isn't about following a rigid formula – it's about crafting an approach that aligns with your unique circumstances, goals, and risk tolerance. For many executives, this complexity is precisely why professional guidance can be invaluable.

Special Considerations for Minnesota Executives

Minnesota's unique tax environment creates both challenges and opportunities for executives considering deferred compensation plans:

Minnesota's High Tax Burden

With a top state income tax rate of 9.85%, Minnesota has one of the highest tax burdens in the nation. This amplifies the potential tax advantages of deferred compensation – pushing current income into the future potentially saves nearly 10% in state taxes alone.

State Taxation of Retirement Benefits

Minnesota fully taxes distributions from deferred compensation plans, unlike some states that offer exemptions for retirement income. This creates planning opportunities around potential relocation in retirement.

Residency and Taxation Rules

Minnesota can be aggressive in claiming tax residency. If you defer compensation while a Minnesota resident and later relocate, the state may attempt to tax those distributions. Careful documentation of residency change and proper timing of distributions is essential.

The Snowbird Strategy

Many Minnesota executives adopt a "snowbird" approach in retirement, maintaining residences in both Minnesota and a lower-tax state. This requires careful planning to establish proper tax domicile in the lower-tax state before receiving distributions.

Minnesota Company Plan Features

Major Minnesota employers like 3M, Target, and Boston Scientific have different NQDC plan structures and features. Understanding the specific provisions of your employer's plan is critical – some offer more investment options, more flexible distribution schedules, or better security provisions than others.

Your Next Steps as an Executive

1. Assess Your Current Situation

- Are you already maximizing other tax-advantaged accounts?

- Do you have excess cash flow that could be deferred?

- Have you reviewed your company's specific plan details?

- What is your time horizon to retirement or other distribution needs?

2. Evaluate Your Company's Financial Health

- Review financial statements, credit ratings, and industry outlook

- Consider company stability through various economic cycles

- Assess how much of your financial future you're willing to tie to your employer

3. Integrate With Your Financial Plan

- Review how deferred compensation fits with your overall retirement strategy

- Coordinate with your tax planning, especially if considering future relocation

- Ensure your liquidity needs will be met despite the deferral

4. Make Informed Elections

- Choose deferral amounts that balance tax benefits against risk

- Select distribution timing that aligns with your retirement plans

- Understand the implications of leaving your employer before receiving distributions

5. Seek Professional Guidance

Deferred compensation decisions are complex and have long-term implications. At Quarry Hill Advisors, we specialize in helping Minnesota executives optimize these plans within their broader financial strategy.

To discuss your specific situation and how deferred compensation might fit into your financial plan, schedule a consultation with our team. The right approach to deferred compensation can significantly enhance your long-term financial position – but only when it's properly aligned with your unique circumstances and goals.

FAQs About Non-Qualified Deferred Compensation Plans

Q: Can I change my distribution elections after making them?

A: Generally, once you make a distribution election, it's difficult to change. Most plans allow changes only if:

- You make the change at least 12 months before the scheduled distribution date

- You delay the distribution by at least 5 additional years from the original date

- The plan specifically permits such changes

Some plans are more restrictive and don't allow any changes, while others might permit changes in cases of documented financial hardship. This inflexibility is why it's crucial to carefully consider your initial distribution elections.

Q: What happens to my deferred compensation if I die before receiving it?

A: If you die before receiving your deferred compensation, the plan typically pays the balance to your designated beneficiary according to the terms of the plan. These payments are usually made either:

- As a lump sum shortly after death, or

- According to the distribution schedule you originally selected

The deferred compensation becomes income in respect of a decedent (IRD) and will be subject to income tax when your beneficiaries receive it. It may also be included in your estate for estate tax purposes. This dual taxation makes it important to coordinate your deferred compensation with your estate plan.

Q: Are there ways to secure my deferred compensation against company risk?

A: There are limited options for securing deferred compensation:

- Rabbi Trusts: While these segregate funds, they don't protect against company insolvency. Assets in a rabbi trust remain subject to the company's creditors.

- Secular Trusts: These truly secure the assets but trigger immediate taxation, eliminating the primary benefit of deferred compensation.

- Company-Purchased Insurance: Some companies purchase insurance to fund their deferred compensation obligations, which can provide some additional security, though not complete protection.

The reality is that the tax benefits of deferred compensation come with inherent company risk. This is why I recommend limiting your exposure to no more than 20% of your retirement assets.

Q: How do NQDC plans interact with Social Security benefits?

A: Deferred compensation impacts Social Security in several ways:

- Payroll Taxes: While you defer the income and income tax, you still pay Social Security and Medicare taxes on the deferred amount in the year you earn it.

- Benefit Calculation: The compensation you defer still counts toward your Social Security earnings record for benefit calculation purposes.

- Taxation in Retirement: Deferred compensation distributions in retirement may increase your provisional income, potentially making more of your Social Security benefits taxable.

Strategic timing of your deferred compensation distributions can help minimize the taxation of your Social Security benefits.

Q: What records should I maintain regarding my NQDC plan?

A: Maintain comprehensive records of your deferred compensation plan, including:

- Plan Documents: The full plan document and any amendments

- Annual Enrollment Materials: Information provided during enrollment periods

- Election Forms: Copies of all your deferral and distribution elections

- Account Statements: Regular statements showing your balance and investment performance

- Distribution Confirmations: Records of all distributions received

- Tax Returns: Copies of tax returns showing how you reported distributions

- Employment Dates: Documentation of your employment periods with the company

These records are particularly important given the long timeframe involved with deferred compensation and the potential for company changes over time. I've seen situations where comprehensive records were needed to prove a participant's rights to deferred compensation years after leaving the company.

Q: Do I need to be concerned about the Section 409A regulations?

A: Yes. The IRS regulations under Section 409A govern deferred compensation plans and impose strict requirements. Violations can result in immediate taxation of all vested deferred amounts plus a 20% penalty and interest charges.

Most company-sponsored plans are designed to comply with these regulations, but it's important to understand that:

- Election timing rules are strict and must be followed precisely

- Distribution timing cannot be accelerated except in specific circumstances

- Companies must administer the plan in strict compliance with its terms

While you don't need to become a 409A expert, you should be aware that these regulations significantly limit flexibility once elections are made.

Q: How does deferred compensation impact my ability to secure loans?

A: Deferred compensation is often not considered by lenders when calculating your debt-to-income ratio because:

- You don't have current access to the funds

- The money is subject to substantial risk of forfeiture

- It's not guaranteed income

If you're planning major purchases requiring financing, consider how deferring income might impact your ability to qualify for loans. This is particularly important for executives who defer significant portions of their compensation.

Schedule an Introductory Call!

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.