Quote to Ponder

"The investor's chief problem—and even his worst enemy—is likely to be himself."

- Benjamin Graham

Investment Outlook

Watch our latest quarterly review video for a comprehensive analysis on navigating market turbulence and the strategic opportunities it presents.

I was planning to write about how we just passed the five year anniversary of the COVID lows, with globally diversified portfolios up about 102% since those dark days.

I was going to highlight how small value stocks have absolutely crushed it, up 204% - handily beating the S&P 500's 133% return.

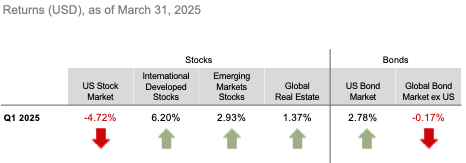

I was even set to point out how international stocks have outperformed this year with an 8% return versus a negative 4% for the S&P 500 as of March 31st.

But then everything changed.

The market took a nosedive after the announcement of potentially historic tariff increases. We've just experienced the most significant three-day drop since 1987, and investors are understandably nervous.

So what should we do? Should we move to cash until things settle down? Should we get more conservative?

I think about it like this: If you're eating right, exercising regularly, and taking care of your health, but you catch the flu - do you suddenly switch to cheese curds and cigarettes? Of course not. You stick with what works for long-term health.

The same applies to investing. Rather than panicking, here's what makes sense right now:

First, this might be a perfect time to rebalance.

We've kept our bond positions extremely safe, and they've held their value well. That gives us dry powder to put back into stocks at these lower prices.

Second, if you've been sitting on cash waiting for an opportunity, this could be it.

Consider starting to dollar-cost average into the market now.

For younger investors, these lower prices are actually good news – you're buying more shares for the same amount of money. And if you're retired, remember that your portfolio is designed with a war chest to get through extended downturns.

Third, we can potentially use this volatility to our advantage.

Tax-loss harvesting opportunities have suddenly appeared, and for some clients, this could be an excellent time for strategic Roth conversions.

I'm reminded of something important: bull markets all tend to look alike - they just go up. But each bear market is unique in its own way. This one has its own specific triggers and concerns.

Yet the most important thing to remember is that we never know exactly how these situations will resolve. In 2009, I sat around a table with fellow advisors, and everyone agreed the market would continue falling. That turned out to be the exact bottom. With no good news in sight, the market reversed course and began a rally that would grow 892% from that point.

The debt ceiling crisis of 2011 created similar uncertainty, but markets are up 470% since then. In 2015, concerns about China's currency devaluation sparked a global economic slowdown. Since that resolution, the market's up 215%.

During COVID, a client challenged me: "Don't you understand what's happening? There's going to be a massive recession, layoffs, government debt, and many deaths. Why should I stay invested?" The only answer I could give was simple: staying invested is what works in the long term. Since that conversation, the market is up 107%.

Corporations aren't sitting idle during market turmoil. They're adapting their strategies, adjusting supply chains, and doing whatever it takes to remain profitable. Our job isn't to outsmart the market. It's to let these businesses and markets work for us over time.

So while the headlines might be scary, remember that we've been here before. Different crises, same discipline. That discipline has rewarded patient investors time and again, and I believe this time will be no different.

That said, I understand this is a challenging time for many investors. Market volatility can be emotionally draining, and it's completely normal to feel concerned.

If you'd like to talk through your specific situation or just need reassurance about your long term plan, please don't hesitate to reach out. We're here to help you navigate these choppy waters!

Q1 Performance by Asset Class

You can access your Quarterly Investment Report online via your Quarry Hill Client Portal.

If you are a new Quarry Hill client, you will receive an invite from “RightCapital” to create your log-in to your portal. Once you log-in, you can follow the directions below to access your report.

1. Click the button below to log in to your portal

2. Click on the folder icon (top right)

3. Click the folder labeled "Quarterly Investment Reports"

Click Here to Access Your Client Portal

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.