Quote to Ponder

"The making of an investment policy – like life itself – involves the practice of rationality under uncertainty." - Nick Murray

Recommended Links

Insight

My children's school principal emailed parents the other day announcing they ran a successful fire drill. All 500 elementary students and teachers were able to vacate the building in under one minute. They planned ahead and practiced. If there are ever real flames and smoke, they can follow the plan instead of allowing fear and panic to drive their decisions as to how to exit the building.

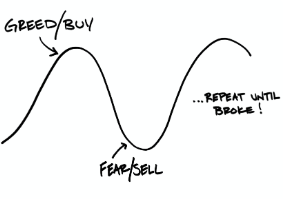

Emotions are an integral part of the human experience. However, our emotions often cause us to make poor decisions. In the realm of investing, two emotions most commonly accompany bad decision-making: fear and greed

Thankfully, we also possess the power of rationality, which enables us to make decisions based on sound judgment rather than impulsive emotions. However, thinking rationally can be tough when our emotions are running high. Our most rational moments occur when we consider our decisions from a distance -- we call this planning.

When recognizing that in the moment, our emotions may get the best of us, we can plan out our actions ahead of time while we are of sound mind -- just like the fire drill at my kids' school.

One of the most important decisions you can make as an investor to combat emotional decisions is to construct an Investment Policy Statement (IPS). It's like a fire drill for your money.

We know many crashes or manias will come and either fear or greed may tempt you to abandon your long-term strategy. An IPS helps remind you why you are invested the way you are in the first place and what actions you committed to taking ahead of time amid uncertainty.

Investing without an IPS is to believe you will act rationally when you most certainly will not. When the next market frenzy rolls in, your IPS will be there to guide you. With this plan in place, you'll be well-prepared, not panicked, allowing rationality to prevail over emotions.

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.