Watch the video below, where I break down what RSUs really are, why diversification matters (even if you love your company), and how to make smarter decisions when your RSUs vest.

Would you ever put your whole bonus into your employer's stock?

What if I told you studies show there's only a 4% chance that would work out in your favor?

Hi, I'm Bjorn Amundson with Quarry Hill Advisors. When it comes to Restricted Stock Units (RSUs), I regularly meet with executives who’ve made costly mistakes. These errors can reduce the value of your equity compensation AND create unnecessary tax headaches.

In this article, I'll walk through the THREE biggest tax mistakes executives make with their RSUs. I’ll explain how to avoid them and share what research tells us about what you should actually do with these shares once they vest.

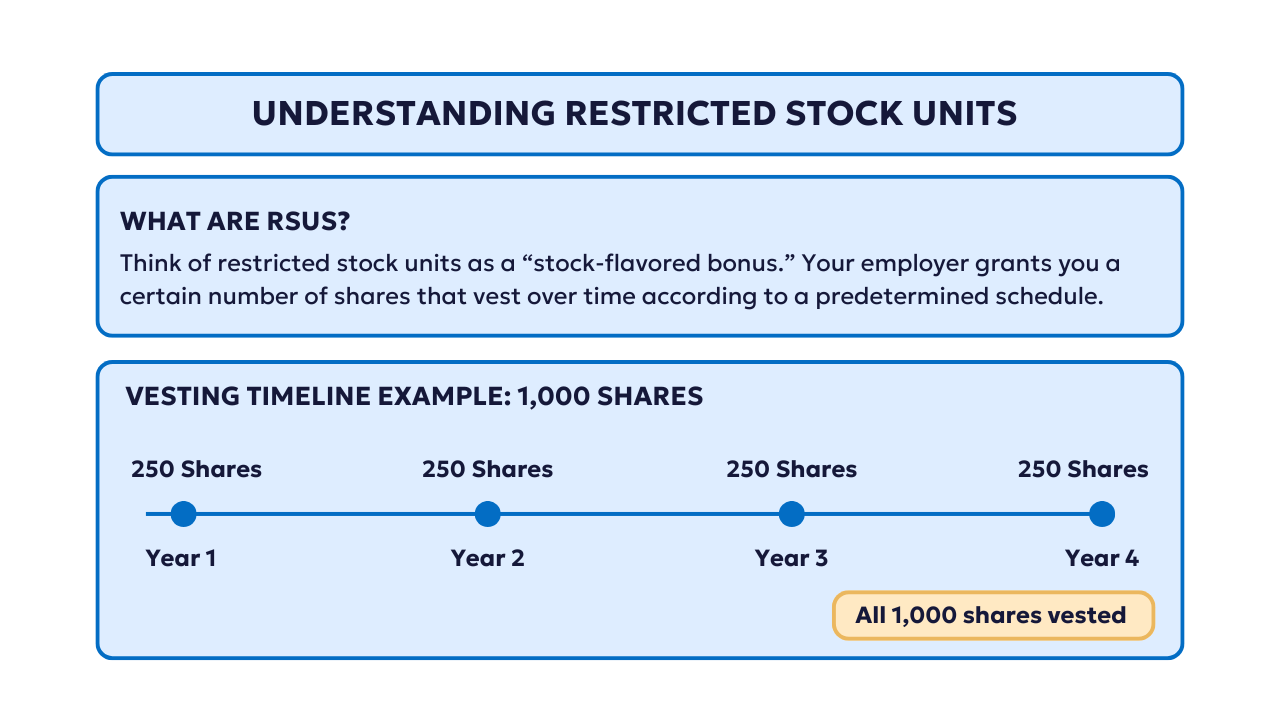

Understanding the Basics: What are RSUs?

Think of restricted stock units as a “stock-flavored bonus.” Your employer grants you a certain number of shares that vest over time according to a predetermined schedule.

For example, if your company grants you 1,000 shares:

- You might receive 250 shares after the first year

- Another 250 shares after the second year

- And so on until fully vested

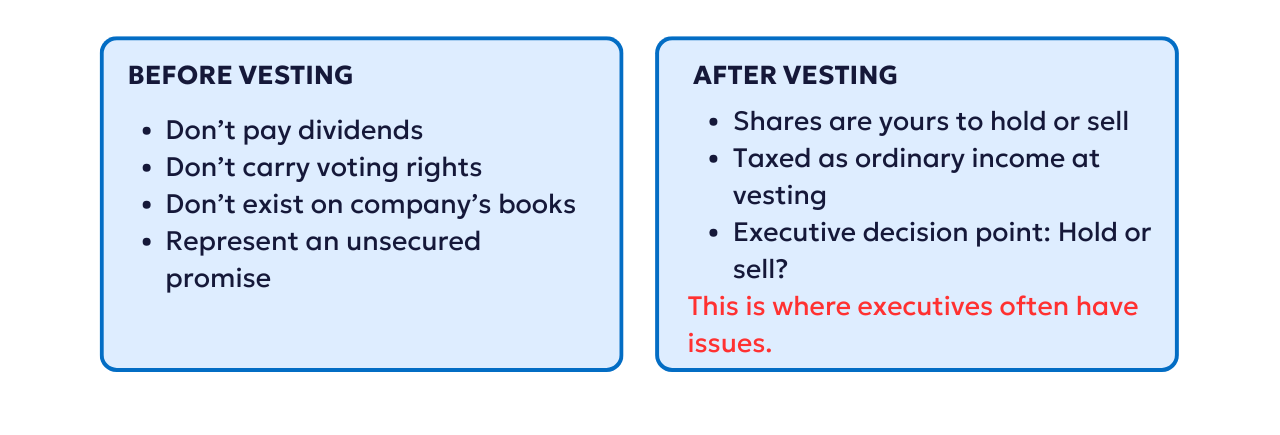

Until these shares vest, they don’t pay dividends. They don’t care about voting rights or even exist on the company’s books. They represent an UNSECURED promise from your employer!

When they do vest, the shares are yours to hold or sell as you choose.

This is where executives often have issues.

Mistake #1: Misunderstanding Long-Term Capital Gains Treatment

The first major mistake I see repeatedly is executives holding onto their vested RSUs because they believe this qualifies the entire value for long-term capital gains tax treatment.

Here's the truth: When your RSUs vest, the full market value of those shares is immediately taxable as ordinary income. It’s the same as if you received a cash bonus. This taxation happens regardless of whether you sell the shares or continue holding them.

Long-term capital gains treatment only applies to any appreciation that occurs after the vesting date.

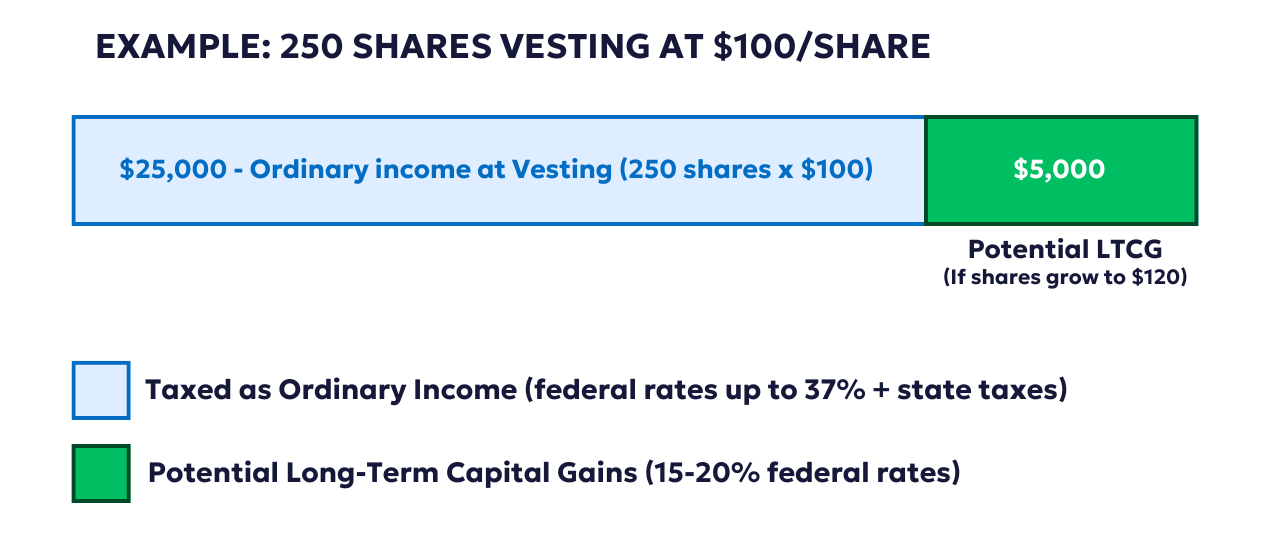

Example:

- 250 shares vest at $100/share = $25,000 in ordinary income

- If you hold and the shares grow to $120, only the $20/share appreciation ($5,000 total) potentially qualifies for long-term capital gains rates

Unless you have a strong conviction that your company stock will significantly outperform the market, holding solely for tax advantages on future gains is often misguided.

Mistake #2: Assuming Default Tax Withholding is Sufficient

When RSUs vest, companies typically withhold taxes automatically. However, most companies withhold at a default rate of only 22% for federal taxes. For many executives in higher tax brackets (potentially up to 37%), this creates a significant tax shortfall.

If you're in Minnesota like many of our clients, you're facing one of the country's highest state income tax rates at 9.85%, making proper withholding even more critical.

The Double Trouble Scenario:

- Your company withholds at the default 22% rate

- You hold the shares, expecting they'll increase in value

- Instead, the stock price drops significantly

- Tax time arrives, and you owe additional taxes at your actual rate

- You're forced to sell shares at a loss to cover a tax bill on the higher original value

I've seen this painful scenario play out too many times. Executives need to either request additional withholding or set aside cash to cover the potential tax gap.

Mistake #3: The Double Taxation Trap

The third mistake is subtle but potentially very costly. Here's how it happens:

- When RSUs vest, taxes are withheld from your paycheck and reported on your W-2

- The shares appear in your brokerage account

- When you sell those shares, the brokerage issues a Form 1099-B

- Often, this form incorrectly shows a cost basis of zero for these shares

- If you (or your tax preparer) don't catch this error, you might pay taxes twice on the same income

How to spot this problem: Check box 1E on your 1099-B (cost or other basis). If it's blank or zero for shares from vested RSUs, you need to adjust your tax return to reflect the correct cost basis, which should be the value of the shares on the vesting date.

If you've already paid taxes twice in previous years, you may be able to file amended returns to recover the overpayment.

What Should You Actually Do With Vested RSUs?

After avoiding these tax situations, the question remains: What should you do with the shares once they vest?

This is where I often challenge executives' thinking. Almost everyone walks into my office believing their company stock is special. They suffer from what psychologists call "familiarity bias,” or the tendency to prefer investments we feel we know well.

But research tells a different story. In a landmark study, Hendrik Bessembinder examined 25,300 US stocks between 1926 and 2016. The shocking finding?

Only 4% of these stocks created the entire wealth in the stock market. The median stock performed roughly the same as cash.

For years, my 3M clients would resist selling their vested RSUs, watching the stock climb and blaming me when they missed out on gains. Then around 2018, 3M's stock dropped over 50% and those same clients suddenly stopped complaining about our disciplined selling approach.

The evidence suggests a clear strategy: As soon as your RSUs vest, sell the shares and diversify. This approach immediately eliminates company-specific risk. It prevents emotional decision making AND avoids the double jeopardy of having both your income and investments tied to the same company.

When to Get Help With Your RSU Strategy

You should consider working with a financial advisor who specializes in equity compensation when:

- You need a comprehensive tax plan that accounts for RSUs and potential withholding gaps

- You've accumulated significant company stock over time and need a strategic diversification plan

- You need guidance on what to do with the proceeds (401(k), backdoor Roth IRA, 529 plans, etc.)

- You're approaching retirement and need to optimize your RSU positions

- You want to donate shares to charity in a tax-efficient manner

Conclusion

RSUs can be a valuable component of your compensation, but avoiding these three major tax mistakes is very important to maximizing their benefit.

Remember:

- Long-term capital gains only apply to post-vesting appreciation

- Default withholding is often insufficient for your actual tax bracket

- Verify the cost basis when selling to avoid double taxation

And perhaps most importantly, don't let familiarity bias cloud your judgment. The statistical likelihood of your company's stock outperforming a diversified portfolio is much lower than most executives believe.

At Quarry Hill Advisors, we help executives develop systematic approaches to their equity compensation that align with research-based investment principles.

If you'd like assistance navigating your RSU strategy, we'd be happy to help.

Schedule an Introductory Call!

Bjorn Amundson is a Partner and Financial Planner at Quarry Hill Advisors, specializing in equity compensation strategies for corporate executives in Minnesota and nationwide.

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.