As an investor, you likely know that long-term capital gains (gains on assets held for over one year) are taxed at a lower rate than ordinary income taxes. What you may not know is whether realizing these gains will cause your wages or IRA withdrawals to be taxed at a higher rate. Whether your company is about to go IPO, you accumulated company stock over many years and are retiring, or you luckily bought Amazon in 1995 (jealous!), you have to deal with the tax impact of a long-term capital gain.

Understanding these two areas of the tax code can be tricky, so to help clarify things, we put together a primer on how these two parts of the tax code interact. Plus, we'll show you some examples of tax planning opportunities that you might be able to benefit from when realizing your long-term capital gains.

Capital Gains and Ordinary Income Tax

There are any number of reasons to take capital gains. Maybe you're coordinating retirement withdrawals or straddling between tax brackets. Or maybe you want to use those gains for a large purchase; after all, one of the reasons taxes are lower on long-term capital gains is to encourage investors to spend that money now instead of in the future. Whatever your reason, before you take those capital gains it's important to understand how it affects your tax burden.

Bad news first: Capital gains will drive up your adjusted gross income (AGI). As your AGI increases, you begin to get phased out of itemized deductions, certain tax credits, and lose your eligibility for Roth IRA or deductible IRA contributions.

And now, the good news: long-term capital gains are taxed separately from your ordinary income, and your ordinary income is taxed FIRST. In other words, long-term capital gains and dividends which are taxed at the lower rates WILL NOT push your ordinary income into a higher tax bracket. The main difference is that the gains are taxed differently depending on whether they're short-term or long-term – short-term gains are included in your ordinary income and therefore are taxed at ordinary income rates. However, long-term gains are a different story. They receive a lower, preferential tax rate.

I'll say it one more time just to put your mind at ease: REALIZING LONG-TERM CAPITAL GAINS WILL NOT CAUSE YOUR ORDINARY INCOME TO BE TAXED AT A HIGHER RATE! This is good news, but that's not all: if you know how to navigate the tax code, taking long-term capital gains can also open up a number of tax planning opportunities.

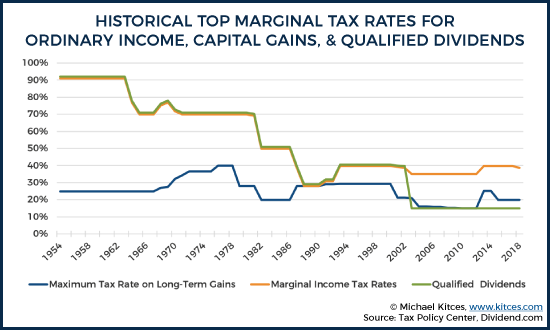

This chart from Michael Kitces outlines the historical tax rates for ordinary income, capital gains and qualified dividends, which should give you a better idea of how the tax code has evolved over the years.

Long-term Capital Gains at 0%

The tax code is filled with quirks. These peculiarities can be frustrating when tax season comes around, but they can also work to your advantage – if you know how to leverage them. For example, one of the oddities in the tax code is the 0% tax rate on long-term capital gains. That's right: it's possible for you to realize a long-term capital gain and pay no tax at all on it.

As of 2025, the long-term capital gains tax is 0% if the seller is roughly in the 12% ordinary income tax bracket (married couples with a combined salary of $89,450 or single filers with an income of $44,725). And if part of that long-term gain is realized in the 12% bracket and crosses over into the 22% bracket (above $89,450), everything up to the 22% threshold is taxed at 0% – only the amount above the 22% will be taxed at the higher marginal rate of 15%.

That's a lot of figures in one paragraph, so let's look at an example. If your ordinary income is $6,000 under the 22% tax bracket (that is, you have $6,000 more room left in the 12% bracket) and you have a $10,000 long-term capital gain, you pay 0% tax on the first $6,000 of the gain; the second $4,000 (which put you into the 22% bracket) gets taxed at 15%. And remember: your ordinary income remains in the 12% bracket.

Roth IRA conversions

The relationship between long-term capital gains and ordinary income also presents a wide range of long-term opportunities for tax planning, including Roth IRA conversions. But before we get into the details of how you can use that relationship to your benefit, we first need to understand what a Roth IRA conversion is and in what cases it may make sense for you.

Roth IRA conversions are a powerful tool in lifetime tax planning. Simply put, Roth IRA conversions give you the opportunity to pay taxes today on your pre-tax retirement accounts, in order to avoid paying taxes on those dollars at any point in the future. However, there are a few important factors to take into account on whether you should convert IRA dollars to a Roth IRA.

Consider the following:

- Will your tax rate be higher in the future than it is today?

- Will your Roth IRA have enough time to grow to offset the initial tax cost that comes with converting a traditional IRA?

- Will your required minimum distributions from your IRA/401k be more than you need to meet your living expenses?

When thinking about converting to a Roth, it's very clear what the benefits are. It has tax-free growth potential and your withdrawals in retirement are tax-free. However, whether a Roth conversion will actually minimize your lifetime tax burden depends on your answers to the above questions. First, converting to Roth usually only makes sense if: 1) Your tax rate will be higher in the future than it is today, and/or 2) Your Roth will have enough time in the market to grow tax-free, in order to make up for the taxable hit of the conversion itself. By converting to Roth, you are paying taxes today in order to save on taxes in the future, but if the tax hit for converting leaves you with less money overall to use in retirement, it's not a wise course of action. So first things first, you need to determine whether a conversion makes sense for you.

The other important consideration is whether your required minimum distributions (RMD) in your 70's would be more income than you need to fund your lifestyle in retirement. If you expect your RMD to be $115,000, but only need $57,500 to meet your living expenses, it may make sense to do a Roth conversion in your 60's -- post-retirement but pre-RMD. The conversion will effectively reduce your RMD and allow the surplus dollars to grow tax-free in the Roth IRA.

Now that you have a bit more clarity on whether a Roth IRA conversion might be right for you, let's move into the relationship between long-term capital gains and Roth conversions.

Long-term Capital Gains and Roth Conversions in Retirement

Let's say you're married, just retired and no longer have earned income. Therefore, you want to convert IRA dollars to Roth to fill up lower tax brackets. But in order to do so, you'll need to realize capital gains to meet your living expenses. Let's say you require $200,000 to meet your living expenses, and to reach that amount you have to realize $150,000 of long-term capital gains.

If tax rates didn't apply to ordinary income first, the Roth conversion amount would stack on top of the $150,000 long-term capital gain. But remember: in this scenario, you no longer have ordinary income, and since tax rates DO apply to ordinary income first, you can convert up to $100,000 of your IRA to Roth in the 10% and 12% brackets (after deductions)!

In this case, you would be giving up the 0% tax rate on the first $78,750 of long-term capital gains, since you are stacking the gains on top of a Roth conversion. However, you give up the 0% rate in order to pay only 10% and 12% tax on the Roth conversion, which can grow tax-free for the rest of your life. Not a bad trade!

Other Tax Planning Opportunities When You Properly Coordinate Capital Gains and Ordinary Income

Understanding the relationship between capital gains and ordinary income taxes – and the order in which they're taxed – can open up a wide range of tax planning opportunities. These opportunities may be available in the following scenarios:

- You are temporarily unemployed

- You work in sales and your salary varies from year to year

- You are between 55 and 73, and you are looking to either transition into retirement or you are already retired

- You sell a real-estate investment for a loss

If you sell appreciated stock or mutual funds to meet your living expenses in a low-tax year (whatever the reason), you will always have the opportunity to convert some of your pre-tax retirement accounts in the lower ordinary income brackets.

Wrap-Up:

Maybe you still have some questions about how capital gains are taxed compared to ordinary income. Maybe you're considering a Roth conversion but need to talk it over to make sure it's right for you (and even if it is, there are a lot of other factors to consider in order to dial in the optimal conversion amount). If you are interested in our wealth management service and have more than $1,000,000 of investible assets (excluding real estate), click the button below to schedule an introductory call to find out if our expertise and services match your needs.

Schedule an Introductory Call!

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.