So your company has decided to go IPO. Now what? An IPO (Initial Public Offering) is exciting, but it can also be overwhelming: you’ve received a sudden windfall, but you may not know how to navigate all the potential implications of an IPO. If you want to make the most of this opportunity, there are a lot of factors to consider. In this post, we'll look at some of them, including whether to diversify your stock, timing your sales around IPO lock-up periods, strategies for protecting your windfall from a market decline, estate planning considerations, and minimizing your tax burden.

Let's get started!

Should I diversify the stock from my company's IPO or keep it?

I've worked with clients who have a strong emotional attachment to their company; others haven't worked for that company in years, and can't wait to sell their stock. Just as no two investors are the same, every company stock is different, so we'll leave the security analysis for another time. When weighing what to do with your company IPO, you first need to decide what’s more important: protecting your current balance, or participating in any future gains? Humans tend to feel the pain of loss more strongly than the pleasure of gain, and that can influence our thinking. So first things first, think about how you’d feel if this stock were cut in half vs. how you’d feel if the stock doubled in value.

As a general rule, it's always prudent to diversify, which means spreading out your risk. When your company goes IPO, you may become an instant millionaire, but your fortune is tied to the ups and downs of a single company. Putting all your eggs in one basket can be a great way to become wealthy, but it isn't always the best way to stay wealthy.

A successful company IPO is a lot like hitting the jackpot on a slot machine. Cashing in and walking away is the smart move, but if you sell all your stock and then it doubles, you'll feel terrible! Annie Duke calls this concept resulting -- blaming yourself for a bad outcome even while making the most prudent decision under conditions with incomplete information. That’s why it's essential to consider process vs. outcome. In light of the unknown future performance of your company, it's a good idea to spread out your risk. If you diversify and then the stock goes up, it may have been a bad outcome, but your decision-making process was sound.

With many of my clients, we sell a portion of their stock but not the entire lot. This allows them to lock in the gains from the IPO and still participate in any potential upside of the company. But how much should you sell? This is different for everyone. However, one approach is to calculate how much money it would take to "endow" specific life goals. For example, if the IPO leaves you with $2M of company stock, but you only need $1M to secure your retirement, then perhaps we start with selling half. Or if your kids are going to college in a few years and $200,000 will completely cover that cost, we can start there and check one big goal off your list. Diversifying is a way of ensuring you meet your financial goals (which reminds me, it’s impossible to overstate the importance of constructing a financial life plan).

Once you decide how much to diversify, the next step is to figure out how to make that happen in a way that minimizes your tax burden and maximizes your share price. However, it's also important to know what you are diversifying to. Many people are not sure how to navigate the world of financial advice – if that's you, it's not your fault, and I apologize on behalf of our archaic and sales-centric industry. The most important question to answer at first is: should I manage my own investments or delegate to a professional? If you decide that your financial future is too important to handle on your own, it's imperative that you find a fiduciary advisor who will put your interests first.

How do I navigate the lock-up period?

Most IPOs have a “lock-up period” that typically lasts 90 to 180 days, during which shareholders are prohibited from selling their shares. The lock-up period exists to make sure that the market isn't flooded with too many shares all at once, which would cause the stock price to fall. If you are currently in the lock-up period, you might be feeling a bit powerless as you watch the stock price rise and fall, knowing you can’t do anything about it (click here for or a deeper look at the mechanics of an IPO).

Once your lock-up period expires, it's common for the stock to experience a sharp decline as an increased supply of shares hit the market at the same time. Since this phenomenon is well known, many short-sellers will be betting against the stock to make a quick buck, which in turn can drive the stock price even lower.

However, sometimes stock prices go up once the lock-up period expires, which presents a wonderful trading opportunity for those looking to diversify. Short-term stock movements are unpredictable, so if a stock that is "supposed to" go down actually goes up, short-sellers are caught in a pinch. We call it a "short-squeeze": The folks that bet on your stock to go down end up artificially boosting the stock price as they try to exit their losing bet. This happened with Shake Shack Inc. ($SHAK) after their lock-up period expired and it sent the stock up another 30%. The Shake Shack Inc. short-sellers essentially helped pay for the stockholders to diversify!

How can I protect my stock from tanking?

Before Mark Cuban owned the Dallas Mavericks and appeared on Shark Tank, he was a tech entrepreneur. In 1995, Cuban and his partner sold Broadcast.com (think prehistoric YouTube) to Yahoo for billions of dollars. As part of the deal, Cuban received 14.6 million shares of Yahoo! which were equal to $1.4 billion. The only catch? He couldn't sell the shares for three years.

Mark Cuban was smart and hired some professionals to help him protect his wealth with what is called a "costless collar" strategy. To put it simply, a costless collar involves buying the right to sell a stock at a lower price while also selling to someone else the right to buy your stock at a higher price. (On second thought, maybe it’s not so simple.)

Let's look at how this works. At the time of the trade, Yahoo! was trading at around $95 per share. To hedge against the stock price tanking, Cuban bought what’s called “put options”: the right to sell all of his stock at $85 per share. That way, if Yahoo! went all the way to $0, Cuban would still receive $1.2 billion. But it costs money to buy options (this cost is known as a “premium”), so in order to cover the cost of buying put options, Cuban also sold put options to other investors at $205 a share. In other words, if Yahoo! took off and went up to $205 or higher, Cuban would have to sell his shares at $205 a share for a total of $3.0 billion. The premium he paid for the right to sell was equal to the premium he collected (that's why it's "costless").

So what happened? You guessed it: Yahoo! fell victim to the bursting of the dot-com bubble and fell from a peak of $300 billion market cap down to only $10 billion. Once Cuban's 3-year lock-up period expired, he was able to sell his shares for $85/share instead of the $13 where Yahoo! was trading. If Cuban had not hedged, he would have lost 85% of his wealth.

A costless collar may be a prudent strategy for you to protect your new wealth. As with anything, it depends on your situation and the cost of the options.

How can my company IPO impact my estate plan?

After any significant financial event, it's essential to have your estate plan reviewed. Of course, the amount the IPO will affect your estate plan will depend on how much your net worth has increased. The Federal Estate Tax Exemption is up to $11.4 million per person now, so most people won't have to worry about estate taxes.

However, many states have a much lower estate tax exemption. For example, here in MN the estate tax exemption is $2.7M. For someone who has $5M of stock after an IPO, simply switching the ownership from individual to joint with a spouse can eliminate any estate tax exposure at the state level.

Another important consideration is family gifting. Given current kiddie tax rules, you can't just gift your kids with unlimited stock to avoid the higher tax brackets. The IRS is smarter than that, and they will levy the kiddie tax on most unearned income. However, a minor can have up to $2,200 of unearned income tax-free. So perhaps it makes sense to hold on to a portion of the appreciated stock you received to use as gifts for your family over the upcoming years.

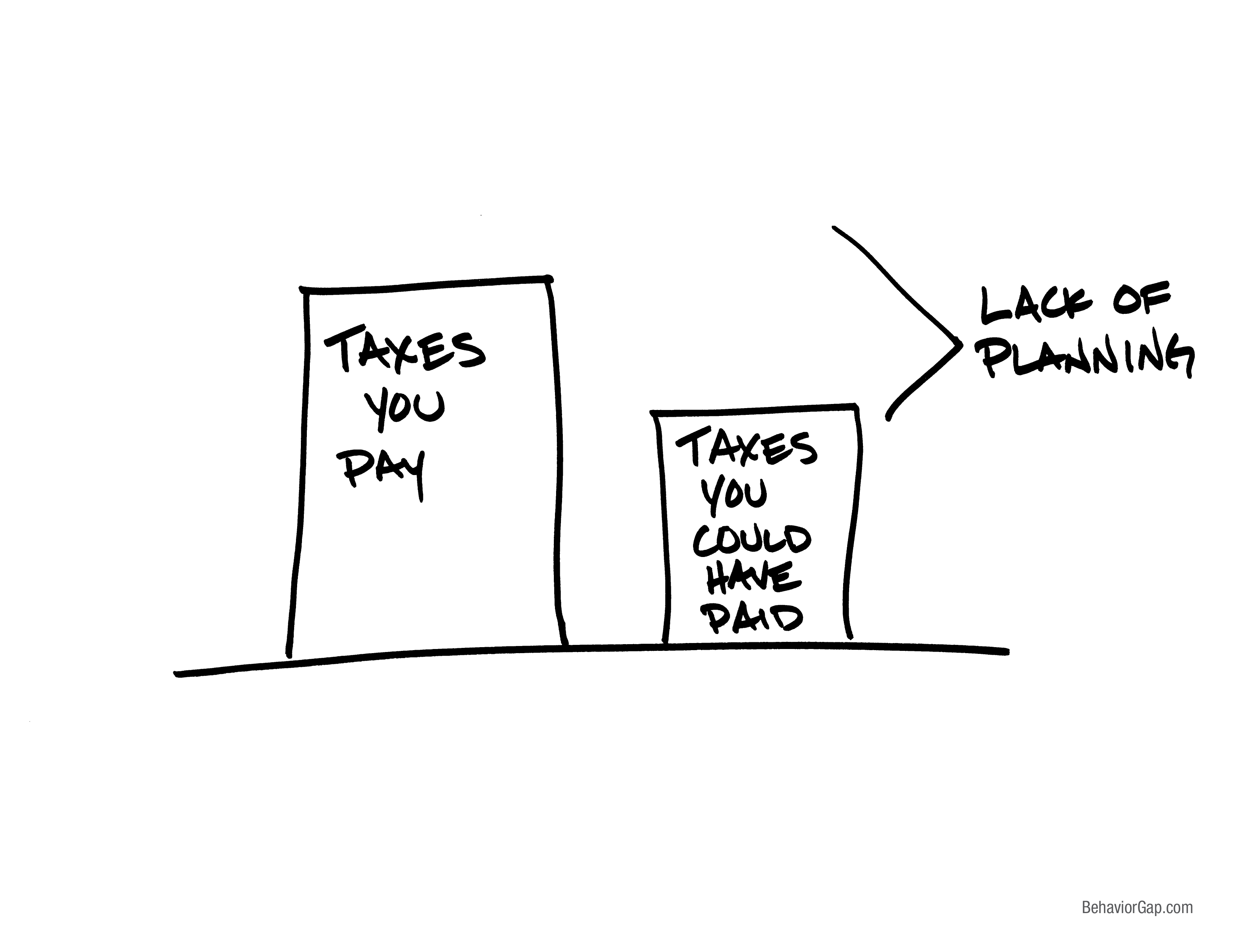

How do I minimize taxes if I sell my stock?

Ok, we're finally at the part you've been waiting for. We all hate paying taxes, but remember: you have every right to seek to minimize your tax burden to the fullest extent of the law. So what are some strategies to help reduce the tax impact of your company going IPO?

The first thing you need to know about is a Donor Advised Fund (DAF). It's a miracle account. A smart DAF strategy will by far have the biggest tax impact for those who are charitably inclined. What if you aren't charitably minded? Well, you probably deserve to pay the tax then (wink).

Let's say you plan to give away $5,000 each year for the rest of your life. If you have 30 years left, that's $150,000. In the year that you exercise options after an IPO or sell stock to diversify, it likely will be the biggest tax year of your life. Wouldn't it be great to pull forward all of your lifetime charitable deductions into that year? Well, with a Donor Advised Fund, you can.

Let's say you plan to give away $5,000 each year for the rest of your life. If you have 30 years left, that's $150,000. In the year that you exercise options after an IPO or sell stock to diversify, it likely will be the biggest tax year of your life. Wouldn't it be great to pull forward all of your lifetime charitable deductions into that year? Well, with a Donor Advised Fund, you can.

You can pull forward a lifetime's worth of charitable deductions by gifting to a DAF. You'll get the full deduction in that year (assuming it's below 30% of your AGI), but you don't actually have to send the gifts to the charity of your choice until you want to. You could theoretically leave the funds in the DAF, invest them, and make the gift to a charity 20 years from now.

The other wonderful thing about a DAF is you can gift your appreciated stock directly into the fund and avoid the capital gains tax on the stock. This is the only "double-dip" that’s allowed in the tax code: You get the charitable deduction on the gift, and you avoid the capital gains tax on the stock that is gifted.

An additional benefit of a DAF is that charitable contributions reduce ordinary income taxes first, before they reduce the lower capital gains taxes (click here for more about the interaction between ordinary income and capital gains taxes). This means that if your charitable deductions wipe out all of your ordinary income for that year, $78,850 of your capital gain will be taxed at 0% federal rates. Plus, anything above that threshold can also benefit by moving down into a lower tax bracket. For an illustration of what this type of planning looks like and the amount of taxes you can save, you can download this scenario to see for yourself.

Another thing to be mindful of is the breakpoint from the 15% to the 20% capital gains tax, which is currently $488,850 in 2019. If you are planning to realize, say, $1M of capital gains, it could make a lot of sense to straddle between the two years to expose as much of the gain to the 15% bracket as possible.

This post just scratches the surface of the financial planning opportunities that become available to you when a company goes IPO. A windfall like this doesn’t come along too often, so if you think you need more guidance than whatever advice you randomly found on google (like this post!), feel free to schedule an introductory phone call. If you have more than $500,000 of investible assets and are looking for both investment management and financial planning, we’ve designed a no-cost, no-obligation process to help us make an informed and educated decision about working together.

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.