Quote to Ponder

"The best way to measure your investing success is not by whether you're beating the market but by whether you've put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.” - Benjamin Graham

Recommended Links

Insight

Instead of celebrating new highs in the stock market, investors tend to worry that stocks might be overvalued and poised for a decline.

On the other hand, when stocks are down, nobody wants to own them out of fear that they may go down further. After all, there is always a frightening narrative attached to each stock market decline.

What makes owning stocks so tricky is you know they will go down, but you just don't know when. Nobody likes seeing their account balance go down, so whether stocks are up or down, the fear of loss is palpable among stock investors.

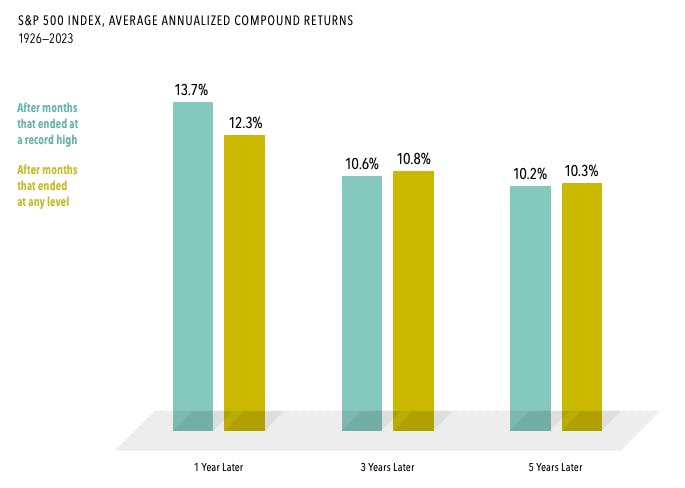

However, when it comes to new market peaks, many are surprised to learn that the average one, three, and five-year returns following a market peak are similar to average returns during any other period of time in history.

Between 1926 and 2023, after all new market high points, average annualized returns ranged from 14% one year later to more than 10% over the next 5 years.

Source: Dimensional. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In US dollars. For illustrative purposes only.

Historically, if investors reduced their exposure to stocks after every market peak, they would have missed out on tremendous returns.

We don't believe the market can be consistently timed for entry or exit points. The data demonstrates that timing the market is a difficult game, and the odds of success are extremely low. The good news is you don't have to play that game to have a successful investment experience.

For nearly a century, stocks have provided compounded returns of nearly three times that of inflation. As an asset class, they have been the greatest generator of effortless wealth in history, and we believe they will continue to do so.

So rather than worrying about stocks' current valuation levels, worry about whether you own enough of them!

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.