Quote to Ponder

“I’m really sorry the long run is taking such a long time.” - Cliff Asness

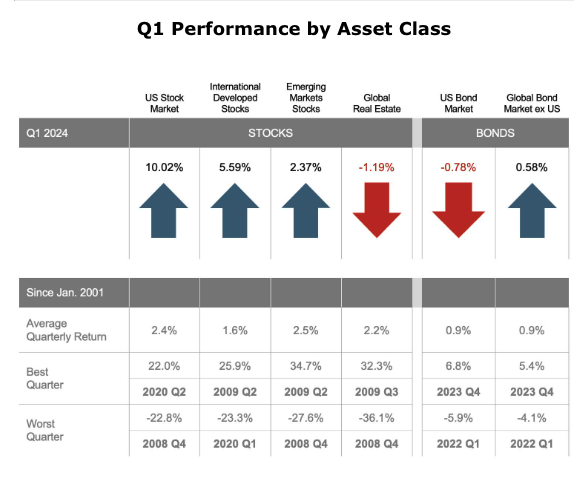

More and more often, I see people online commenting you should just “buy the S+P 500 and chill.” What they mean is, put your money in the 500 largest companies in America and let it ride. Their argument is compelling on the face of it. Since 1970, the S+P 500* has compounded at 10.7% vs. 8.4% for international stocks. This additional 2.3%/year of returns for US stocks has compounded to mean that each dollar in US stocks since 1970 has grown to $242 while a dollar in international stocks has only grown to $79. Apart from the pure returns, none other than Warren Buffett plans to have his widow’s trust invested 90% in the S+P 500 and 10% in US Treasuries.

Sometimes International Wins Big

Although the US has outperformed more recently, if you had started investing in 1970, you would have wanted to invest internationally. Between 1970 and the end of 1989, international turned in over 15%/year, growing $100,000 into $1.64 Million vs. only $790,000 for the S+P 500. So, someone starting to invest in 1990 would have looked at the last 20 years and believed that international investment was the best place to invest.

The Smartest Minds in Finance Disagree with US-Only Portfolios

The global stock market is extremely “efficient.” This means that the market does a remarkable job of finding the correct price of assets. It’s so effective at this because all the smartest minds in finance are looking at the prices of assets minute by minute, trying to outperform their competitors. Something gets too low? They buy. Something gets too high? They sell. If you put all your assets in the US, you are disagreeing with the average of all the smartest minds in finance who presently place the US market at about 60% of the global stock market value.

US Stocks Are WAY More Expensive Right Now

According to JP Morgan’s Guide to the Markets, The US stock market currently trades at a Price/Earnings ratio of 20.9 vs. its average of 16.7 (lower is better!). Europe presently trades at 14.7 (about it’s average). Emerging markets are all the way down at 12.2. The cheaper you can buy an asset, the better.

Most of The Genius’s Are Outside the US There are roughly 333 million people in the United States, and 7.5 BILLION people who don’t live in the United States. This means that there are roughly 1.2 million people with a genius-level IQ inside the United States and 28.9 Million outside the United States. That means for every genius in the United States there are roughly 24 outside the United States. Do you really want to exclude the vast majority of geniuses from your portfolio?

ALL of the US Outperformance Has Happened Since 2008

If you look at the performance of US vs. International through 2008, the performance is roughly identical. Nearly all the outperformance listed above occurred since then.

In our lives, ten years feels like an eternity. But in investing, 10 is just another data point - adding to the information but not changing the importance of diversifying within stocks, asset classes and countries. Keep doing the right thing (long enough), and diversification pays off.

*Source: Returnsweb: S&P 500 Data from Standard & Poors Index Services Group January 1926 - December 1989: S&P 500 Index Source: Ibbotson data courtesy of © Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated works by Roger C. Ibbotson and Rex A. Sinquefield).

**MSCI World ex USA Index (net div.) 1/1970 - 3/2024 Source: MSCI.Total returns net dividends

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.