A year ago, the S&P 500 slumped 20% to enter bear market territory. Financial headlines screamed:

“S&P 500 Enters Bear Market as Investors Brace for Recession”

“Inflation Hits 40 - Year High, Raising Fears of Recession”

“Stocks Slump as Recession Fears Mount”

“Inflation is Here to Stay, Economists Warn”

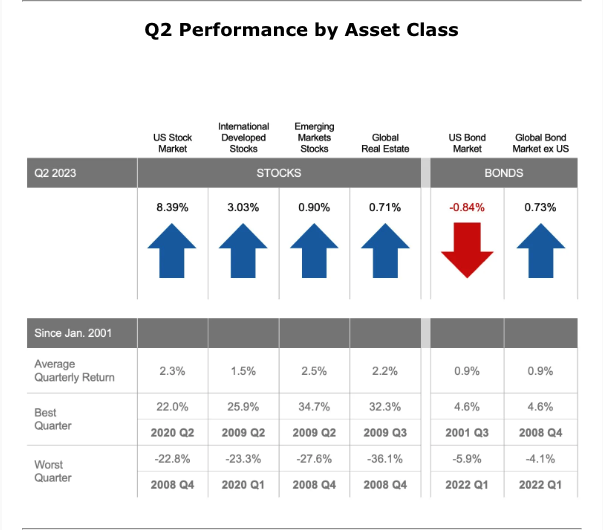

Since then, the S&P 500 is up nearly 20%, with international stocks up nearly the same. This recovery took place despite rising interest rates, high inflation, the war in Ukraine, a few bank collapses, and a debt ceiling crisis. The adage “Be fearful when others are greedy and be greedy when others are fearful” has never been truer.

Here are three lessons that investors can learn from the tumultuous year in the financial markets:

Lesson 1: Stay the Course

Volatility is an inherent part of investing. It's easy to succumb to panic when the markets are falling, but one must remember that they are simply part and parcel of the economic cycle. The recovery in the S&P 500 and international stocks shows that those who stayed the course and did not sell in panic were able to participate in the recovery. The roller coaster of the financial markets may be jarring, but it's important to maintain a long-term perspective. There will always be periods of decline, but history shows us that markets tend to rise over the long term.

Lesson 2: Diversification Matters

The recovery wasn't limited to just the S&P 500. International stocks also saw a similar uptick. This underscores the importance of diversification in investing. Having a mix of different types of investments can help to spread risk. When one market or asset class is doing poorly, another might be performing well. By diversifying, investors can protect themselves against single-market volatility and increase their chances of enjoying a smoother, more consistent, and positive investment experience.

Lesson 3: Don't Try to Time the Market

The last year has been a testament to the difficulty and risks associated with trying to time the market. When the S&P 500 entered bear market territory, many predicted a prolonged recession. Yet, the market recovered considerably within a year. Predicting market movements with accuracy consistently is near impossible as we can see from the news headlines from a year ago.

To be a successful investor, you must maintain a disciplined, diversified, and long-term approach to investing, regardless of what the headlines say. Market downturns can indeed be nerve-wracking, but they also present opportunities for those who remain patient, level-headed, and focused on their long-term financial goals.

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.