Let's Gamble

Here's a thought experiment.

Which of the following do you prefer?

Gift A: A lottery ticket that offers a 50% chance of winning $1,000

Gift B: A certain gain of $500

If you are like me, you chose the certain gain of $500. It's a sure thing, right? I'd hate to not win anything. Now let's turn the tables and try it again.

Which of the following would you prefer?

Loss A. A lottery ticket that offers you a 50% chance of losing $1,000

Loss B. A certain loss of $500

Oh. That feels a bit different. I don't know about you, but in the face of a certain loss, I'm willing to roll the dice and take my chances to avoid losing anything.

Why is it that when we are given a choice between a gift of $500 and a 50/50 shot at winning $1,000, we take the sure thing, but when given the choice between a certain loss of $500 and a 50/50 shot at losing $1,000, we take the bet? It's the same amount of money, the only difference is that one is a loss and the other is a gain.

The answer lies in our innate wiring as human beings and it has a significant impact on our behavior as investors.

You are Wired to Fear Loss

These experiments were run by famed psychologists Amos Tversky and Danny Kahnemann back in the 1970's, paving the way to Nobel Prizes in the field of economics.

Tversky and Kahnemann found that "when choosing between sure things and gambles, people’s desire to avoid loss exceeded their desire to secure gain."

The reason, they surmised, was that “happy species endowed with infinite appreciation of pleasures and low sensitivity to pain would probably not survive the evolutionary battle." In other words, humans didn't get here by appreciating pleasure and fearing pain to the same degree.

Our innate aversion to of loss (or pain) has helped humans survive.

Investing and Loss Aversion

So how does loss aversion influence how we behave when investing in the markets?

Let's take a look at the current market environment. Even while reaching all-time highs, rather than celebrating, market participants can't help but fear the rug being pulled out from under them.

Since we feel the pain of loss to a greater degree than the joy of gain, it doesn't help that the markets tend to go down on an elevator and take the stairs up. Such is the reason why even though markets have handsomely rewarded patient investors over time, many feel as though the market is more of an enemy than a friend. Our emotional reactions to the steep declines stay with us in a way that the gradual upward climb of the market does not.

Whenever we reach all-time highs, investors are tempted to believe they are standing on a mountain peak -- and the only possible direction from there is down. They scramble, looking for help in any direction in order to avoid the steep descent.

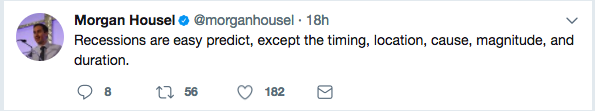

Despite all evidence of the unpredictability of future market returns, investors look to supposed soothsayers who think they can predict the timing of the next recession.

Because of the desire to avoid loss, investors make any number of fatal mistakes. Since the 20% S&P 500 drop in 2011, many were spooked into thinking it was going to be 2008 all over again and end up missing out on the subsequent 6-years of gains.

Overcoming Our Biology

It would be impossible to rewire our brains to eliminate our loss aversion, nor should we want to, but we can take steps to avoid its traps.

The first step is to realize that your investment portfolio declining by 20% is not the same as a tiger pouncing on you in the jungle. Your physiological response to both threats may be identical, but if you are committed to viewing them the same way you have more problems than I can help you with.

Secondly, unless you have a disciplined investment plan in place, your emotions will always get the best of you. That's why you need an evidence-based philosophy that regards market-timing as fruitless and predictions as useless. You need a portfolio maintenance strategy that outlines exactly when trades are to be made so that when the scary times do come, you already have a plan.

The market will go up, and it will go down. For sticking through the scary days you will be rewarded over time. We can't control the market -- and aside from your investment strategy, the only thing you can control is yourself.

So next time you feel tempted to fret over what might happen next in the markets, don't let the fear of your portfolio declining impede its growth.

Quotes are taken from The Undoing Project by Michael Lewis