.png)

Most people who give to charity are making a costly mistake every single year—and they don't even know it.

If you're someone who regularly gives to charity and owns investments that have grown in value, you could be caught in what I call the "double tax trap." This mistake costs the average charitable family between $2,000 to $5,000 annually in unnecessary taxes.

The good news? There's a simple strategy that can eliminate this tax burden completely while allowing you to give the same amount to the causes you care about.

The Double tax trap: how generous families overpay

Here's how the trap works. Most generous families follow the same pattern year after year:

- They write a check or transfer cash from their bank account to charity

- Later in the year, they sell appreciated investments to fund other goals or rebalance their portfolio

- When they sell those investments, they trigger capital gains taxes

Let's use a real example. Say you give $12,000 annually to charity. You write checks throughout the year. Simple enough.

But you also have stock you bought for $6,000 that's now worth $12,000. When you sell it, you'll pay capital gains tax on that $6,000 gain; potentially $2,000 or more to the IRS.

So you've given $12,000 to charity and paid $2,000 to the government. You're out $14,000 total, but your charitable impact was only $12,000.

The result? Generous families continue overpaying taxes year after year, thinking this is just the cost of being charitable, when there's actually a simple way to eliminate this entire tax burden.

Strategy #1: Direct Stock Donation

Instead of giving cash to charity, gift your appreciated investments directly to the charitable organization.

Here's why this works so well. When you donate appreciated stock that you've held for more than a year, two powerful things happen:

First, you completely bypass capital gains taxes. The stock goes from your account directly to the charity's account, and neither you nor the charity pays capital gains tax on the growth. The government simply never collects this tax.

Second, you still get to deduct the full current market value of the stock as a charitable deduction on your tax return.

Let's revisit our example. Instead of selling your $12,000 of stock (and paying $2,000 in capital gains), then donating $12,000 in cash, you simply donate the $12,000 of appreciated stock directly.

The result? You get the same $12,000 charitable deduction, but you keep the $2,000 you would have paid in taxes.

Real Example: $250k Household Saves $2,000 Annually

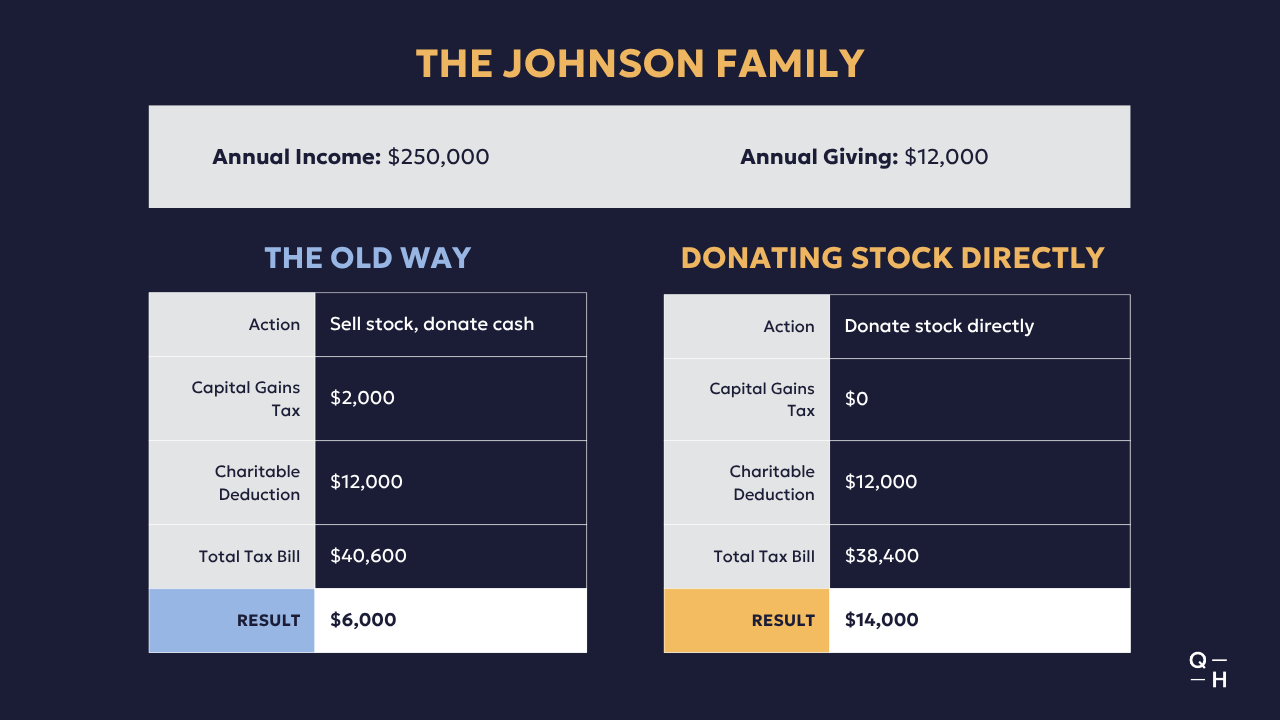

Let me show you how this works for a real family. This family earns $250,000 annually and gives $12,000 to charity each year.

Over 10 years, this simple strategy saves them $20,000 in taxes while giving the exact same amount to charity.

Strategy #2: Donor-Advised Funds for Maximum Flexibility

Now, donating stock directly works great if you know exactly where you want your money to go. But what if you support multiple charities? Or you're not sure yet where you want to give?

That's where donor-advised funds shine.

A donor-advised fund (DAF) is basically like a charitable investment account. You donate your appreciated stock to the fund, get your immediate tax deduction, and then recommend distributions to specific charities over time.

Three Big Advantages of Donor-Advised Funds:

- One Donation, Multiple Charities: You can make one stock donation for tax purposes but support multiple charities throughout the year. Give your $12,000 of appreciated stock once, then have monthly checks going out to all the charities you support.

- No Rush to Decide: You don't have to immediately decide where every dollar goes. Take your time to research charities or respond to needs as they arise throughout the year.

- Tax-Free Growth: The money in the donor-advised fund can grow tax-free until you decide to distribute it, potentially allowing you to give even more to the causes you care about.

Strategy #3: The Bunching Technique to Multiply Your Tax Savings

Here's an advanced technique that can multiply your tax savings: Instead of giving the same amount every year, "bunch" multiple years of giving into one year, then give nothing the next year.

Let me explain why this works.

The Standard Deduction Problem

For 2025, the standard deduction for married couples filing jointly is $31,500. This means everyone gets to deduct this much automatically.

To benefit from itemizing deductions (which includes your charitable giving), you need to exceed this threshold. Your itemized deductions include:

- State and local taxes (up to $40,000 subject to phase-out)

- Mortgage interest

- Charitable giving

Most families can't get over this threshold, so they get no additional tax benefit from their charitable giving.

The Bunching Solution

.png?width=1280&height=720&name=Gifting%20Appreciated%20Stock%20Blog%20Graphics%20(1).png)

Year 2: Take the standard deduction while distributing $12,000 from donor-advised fund to charities

The Tax Savings

By bunching two years of giving into one year:

- Federal taxes drop from $40,600 to $36,000

- State taxes drop from $15,600 to $13,700

- Total savings: $7,000 over two years

And remember, their charitable impact stays exactly the same. They're still giving $12,000 annually to the same charities. They're just doing it in a more tax-efficient manner.

Putting It All Together

The double tax trap costs charitable families thousands of dollars every year because they're selling investments and giving cash separately instead of giving the investments directly.

Here's your action plan:

Level 1: Basic Stock Donation Donate appreciated stock directly instead of cash. Savings: $2,000+ annually for most families.

Level 2: Donor-Advised Fund Add flexibility by using a DAF to manage your giving throughout the year while maximizing tax benefits.

Level 3: Bunching Strategy Combine your stock donation with bunching multiple years of giving to maximize deductions. Savings: $5,000-$7,000+ over two years.

The family in our example saved $2,000 annually with basic stock donation, and over $7,000 with the advanced bunching strategy—all while giving the same amount to charity.

Your Next Steps

Now that you understand how the double tax trap might be costing you thousands annually, you can make more strategic decisions about your charitable giving.

The key is to implement these strategies before year-end to capture the tax benefits for this year. Most donor-advised funds can be set up quickly, and transferring appreciated stock is typically a straightforward process.

If you want to learn more about how we help clients implement these advanced charitable giving strategies, schedule a call with our team. We can discuss your specific charitable giving goals and create a customized strategy that maximizes your impact while minimizing your taxes.

Remember: The goal isn't just to give more, it's to give smarter. With the right strategy, you can support the causes you care about while keeping thousands of dollars that would otherwise go unnecessarily to taxes.

Ready to find out if we're the right fit for your financial planning needs? Schedule a complimentary discovery meeting where we'll provide a real assessment of how we can help your specific financial situation.

-A note from Bjorn Amundson, CFP®

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.