Scary Markets are Normal Markets

We've been spoiled by a few years of all gain and no pain in the markets. After nearly two years with hardly a negative month, the global markets are starting to return to normalcy. We've had a few days of negative performance, and the financial media would have you believe it's somehow out of the ordinary.

However, what's actually out of the ordinary is how the last two years have been. After being lulled to sleep with consistent investment gains, it's easy to forget just how normal stock market volatility is.

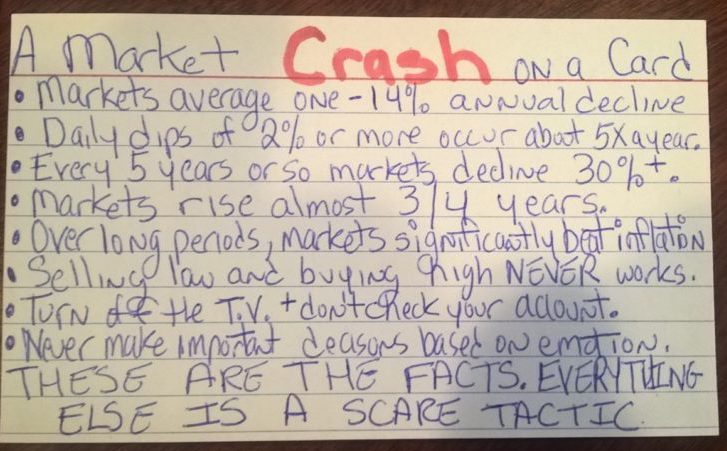

An index card has been making its way around the financial web bringing the sense back to spooked investors. It's a breath of fresh air. Take a look.

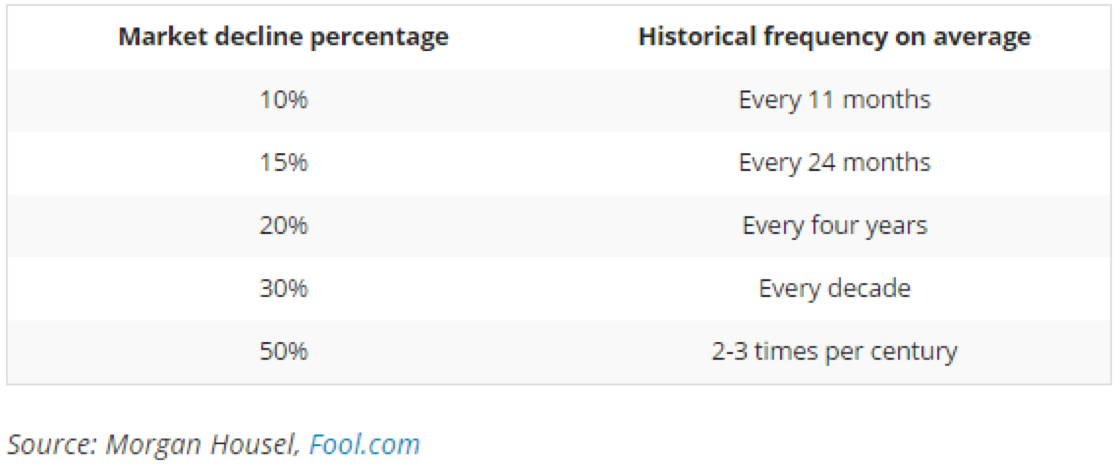

Did you realize how often market dips occur? If you are Quarry Hillclient, you might remember my slide that shows the historical frequency of 10%, 20%, 30%, 40%, and 50% declines. It's much more often than you think.

Volatility is part of the game. Prices fluctuate. A lot. And often. This is the price you pay for the tremendous growth that has rewarded disciplined investors over the long-term.

What Should I Do with my Portfolio?

Financial markets have a habit of behaving unpredictably in the short run. I have no idea whether this decline will continue downward or march back upwards. My crystal ball is always cloudy. In fact, all crystal balls are cloudy.

There are only a few things within our control, and the future isn't one of them. What we can control is diversification,tax efficiency, allocation, costs, and most importantly: disciplined rebalancing instead of emotional trading.

A Market Strategy You Can Stick With

Markets will always be turbulent, we just don't know when. Since timing the market is a fool's errand, you won't get paid for the good times unless you weather the bad. This is why you need an investment approach you can stick through uncertain times.

So as the mysterious index card writer would say, don't fall victim to the scare tactics. This is normal, and it too shall pass, as will the next decline, and the next, and the next...

If you are feeling scared and need more facts, let's talk -- I have plenty.

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.