When it comes to financial planning, one of the most crucial aspects to consider is your cash flow. Understanding where your money is going and how much you have left can be challenging, especially as your life gets complex. It’s hard to track, and even harder to project what you need.

Worse yet, money can be a huge area of guilt. This means as income grows, expenses do as well. Other times, someone saves to achieve financial freedom, but then once they get there, they can’t give themselves permission to spend guilt free.

Traditional budgeting attempts to address this issue, but let's face it, it's not for everyone. In my 20 years of experience, I've encountered only a handful of proficient budgeters. For the majority of people, a different approach is needed. That's where The Simple Spend Method comes in.

Introducing The Simple Spend Method

The Simple Spend Method is a straightforward and guilt-free way to manage your finances. Unlike traditional budgeting, which focuses on tracking where your money went, this method helps you determine if you're free to spend money right now.

Here's how it works:

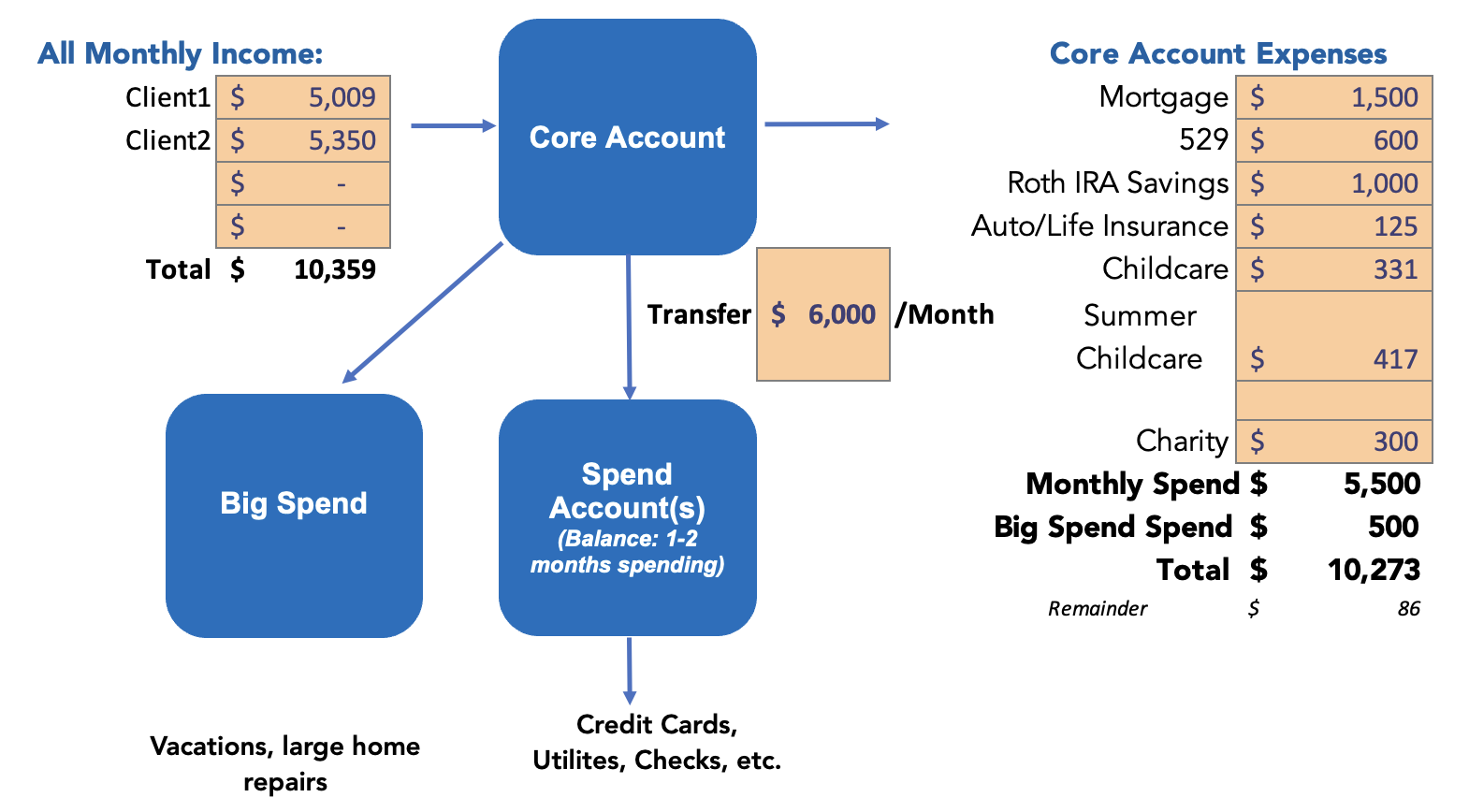

- Two Separate Checking Accounts: Instead of using a single checking account for all transactions, The Simple Spend Method involves two separate accounts: the core account and the spend account. Both have to be a checking account because you're only allowed to make six transfers per month out of a savings account. You might be missing out on some interest by having all that cash sitting out in a checking account but for the simplification it's probably worth it.

- Core Account: This is where all your income goes. Whether it's your salary, social security benefits, rental proceeds, or any other source of income, it all goes into the core account. Think of the core account as your cash reserve, where you keep enough to cover three to six months of expenses. Out of this account, you take expenses that are recurring and that will maybe someday change like:

- Mortgage

- Savings (including retirement contributions)

- Insurance premiums

- Childcare expenses (Daycare)

- Charitable contributions

- Taxes

- Spend Account: This account is for your day-to-day expenses. It should initially contain one to two months' worth of spending. Each month, an amount equivalent to your monthly spending is transferred from the core account to the spend account. Expenses covered by the spend account:

- Groceries

- Utilities

- Small purchases

- Vacations

- Lifestyle expenses

- Day-to-day purchases

- Core Account: This is where all your income goes. Whether it's your salary, social security benefits, rental proceeds, or any other source of income, it all goes into the core account. Think of the core account as your cash reserve, where you keep enough to cover three to six months of expenses. Out of this account, you take expenses that are recurring and that will maybe someday change like:

Twice per month (on the 1st and 15th), transfer your monthly spending amount from the core account to the spend account. This ensures that you always know how much you have available to spend. Using the spend account for everyday purchases and expenses allow you to be more free with spending.

How It Works in Practice

Let's consider an example,

- A family spends approximately $6,000 per month.

- Both spouses earn about $5,000 per month, totaling $10,000 in monthly income.

- All income goes into the core account.

- Various expenses, including the mortgage, savings, insurance premiums, childcare, and charity, are deducted from the core account.

- $6,000 is transferred from the core account to the spend account each month.

- Any expenses related to the family's lifestyle come out of the spend account.

- If there's money in the account, you're free to spend it. If not, it's time to reevaluate your spending habits.

Benefits of the Simple Spend Method

The Simple Spend Method offers several advantages over traditional budgeting:

- Easy Budgeting: If there’s money in your spend account, you can spend it. It doesn’t really matter whether it goes to groceries, gas or clothes. All that maters is

- Savings as a Default: By separating your expenses into two accounts, the Simple Spend Method makes savings the default option. Instead of seeing extra money in your checking account and spending it impulsively, you'll prioritize saving for the future.

- Flexibility and Simplicity: Unlike complex budgeting systems, the Simple Spend Method is easy to understand and implement. It works with any bank and doesn't require complicated spreadsheets or tracking tools.

Tailoring The Method to Your Needs

While the Simple Spend Method provides a framework for managing your finances, it's essential to customize it to suit your unique needs and circumstances. Experiment with different spending amounts and adjust as needed to find what works best for you.

Ready to take control of your finances and enjoy guilt-free spending? Give the Simple Spend Method a try. Remember, financial planning is not one-size-fits-all. Experiment with The Simple Spend Method and adjust it as needed to find what works best for you. If you have any questions or need assistance, don't hesitate to reach out. We're here to help you make smart decisions with your money.

To watch the Youtube video, click here

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes a recommendation for purchase or sale of any security, investment advisory services or tax advice. The information and opinions expressed in the linked articles are from third parties, and while they are deemed reliable, we cannot guarantee their accuracy.